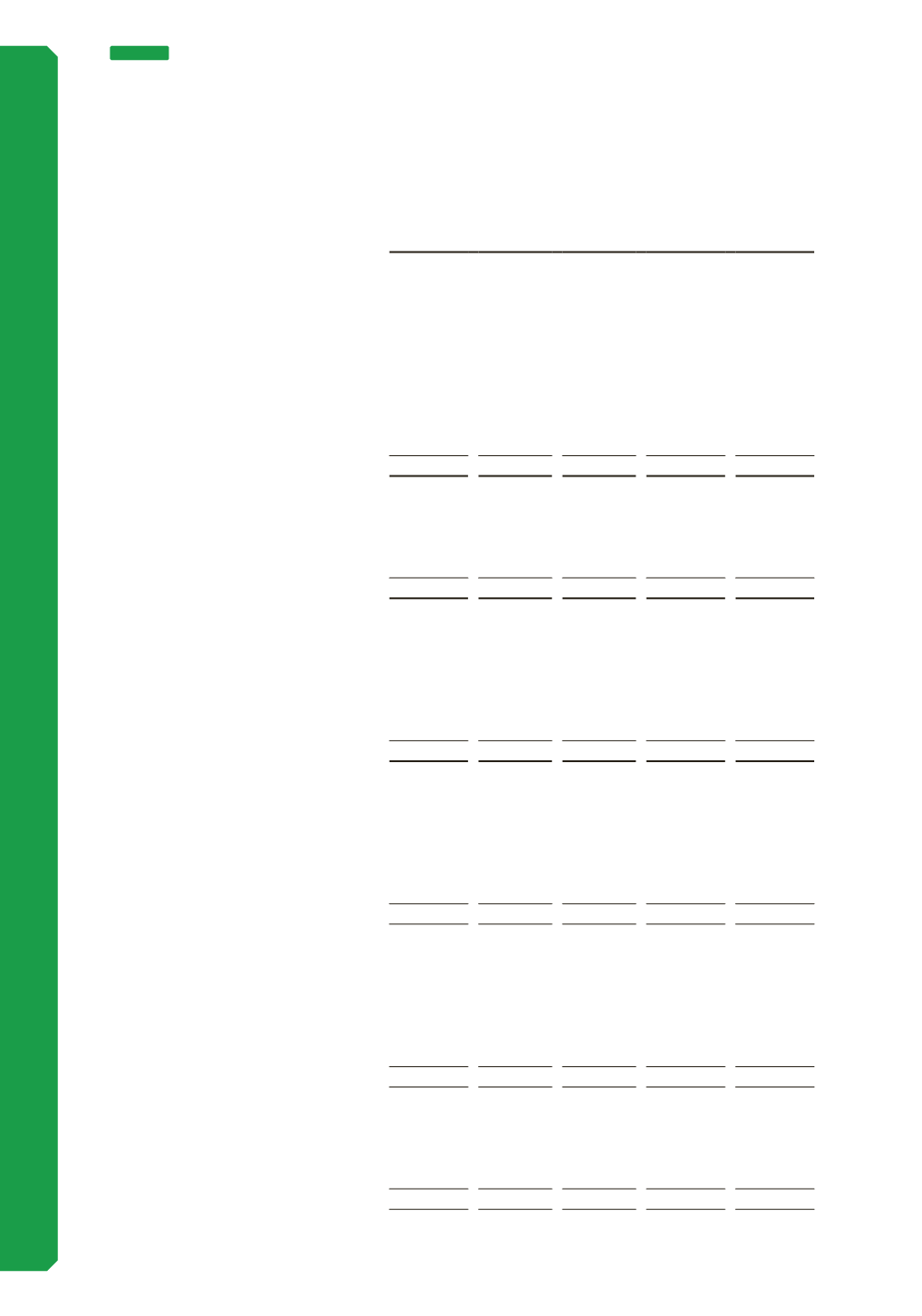

Fair Value

30 June 2017

Notes

Carrying

Value

$’000

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

Non-financial assets

Designated at fair value

Leasehold improvements -

infrastructure assets

7(c) 3,232,992

-

- 3,232,992 3,232,992

Plant & equipment -

infrastructure assets

7(c)

676,164

-

- 676,164 676,164

Total non-financial assets

3,909,156

-

- 3,909,156 3,909,156

Financial assets

Loans and receivables

Trade and other receivables 6(b)

72,688

-

-

-

72,688

Cash and cash equivalents 6(a)

108,236

-

-

- 108,236

Total financial assets

180,924

-

-

- 180,924

Financial liabilities

Fair value - hedging instruments

Foreign exchange contracts 11(a)

19

-

-

-

19

Other financial liabilities

Interest bearing liabilities

6(d)

514,673

-

-

- 514,673

Trade payables

6(c)

80,701

-

-

-

80,701

Total financial liabilities

595,393

-

-

- 595,393

30 June 2016

Non-financial assets

Designated at fair value

Infrastructure assets

7(c) 3,349,009

-

- 3,349,009 3,349,009

Plant & equipment -

infrastructure assets

7(c)

675,835

-

- 675,835 675,835

Total non-financial assets

4,024,844

-

- 4,024,844 4,024,844

Financial assets

Fair value - hedging instruments

Foreign exchange contracts 11(a)

38

-

38

-

38

Loans and receivables

Trade and other receivables 6(b)

64,807

-

-

-

64,807

Cash and cash equivalents 6(a)

107,461

-

-

- 107,461

Total financial assets

172,306

-

38

- 172,306

Financial liabilities

Other financial liabilities

Interest bearing liabilities

6(d)

644,131

-

-

- 644,131

Trade payables

6(c)

82,001

-

-

-

82,001

Total financial liabilities

726,132

-

-

- 726,132

110

NOTE 11

FINANCIAL RISK MANAGEMENT (CONTINUED)

(d) Fair value measurements (continued)

(i) Fair value hierarchy and accounting classification (continued)