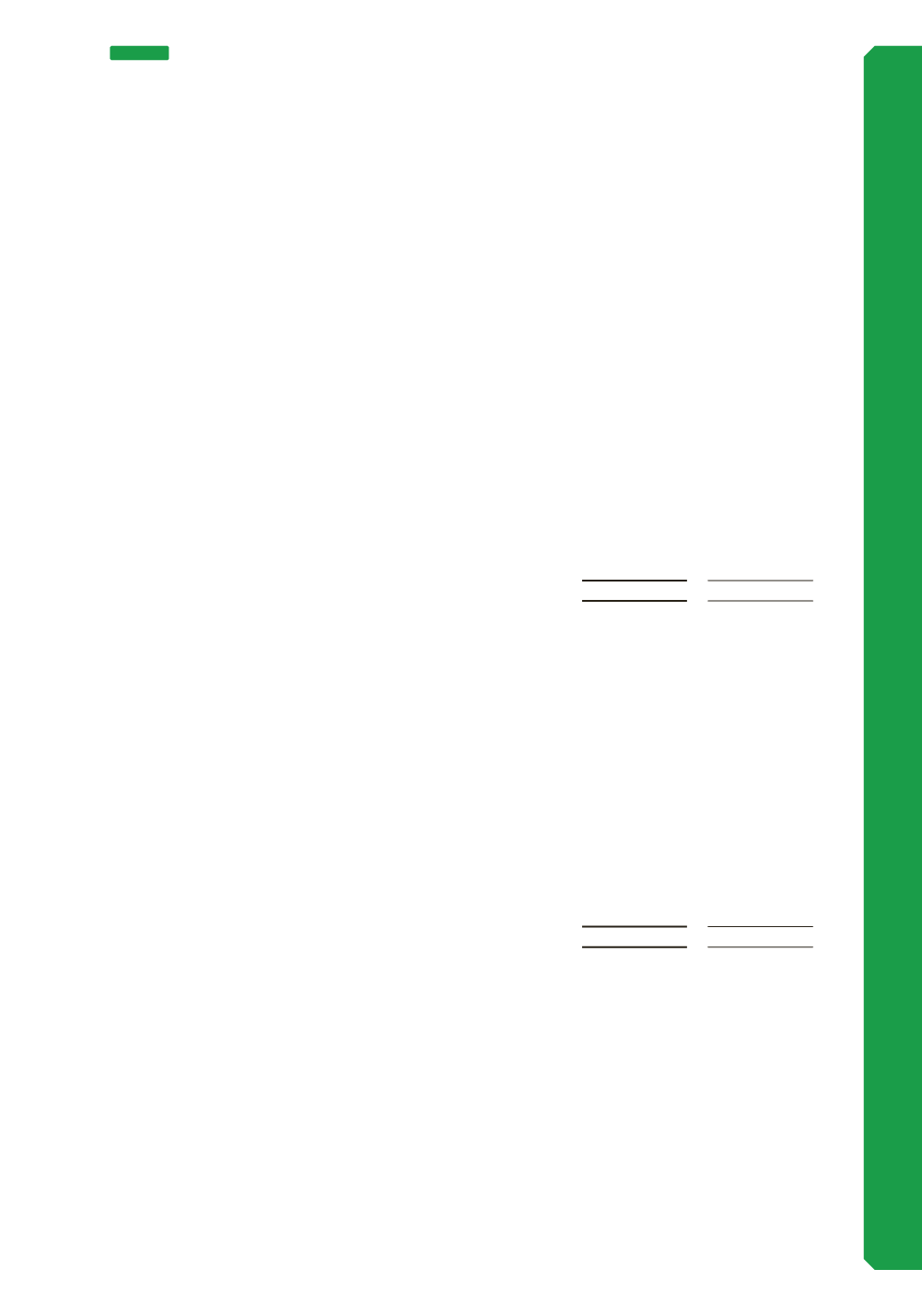

Movements in the provision for impairment of trade receivables that are assessed for impairment

individually are as follows:

The creation and release of the provision for impaired receivables has been included in ‘other

expenses’ in the income statement. Amounts charged to the allowance account are generally

written off when there is no expectation of recovering additional cash.

Consolidated

2017

$’000

2016

$’000

At 1 July

(31)

(24)

Provision for impairment charged to other expenses

during the financial year

(108)

(13)

Receivables written off during the year as impaired

trade receivables

25

6

At 30 June

(114)

(31)

107

Consolidated

2017

$’000

2016

$’000

Neither past due nor impaired

50,803

31,849

Past due but not impaired

30 - 60 days

8,319

18,660

61 - 90 days

320

11

> 90 days

110

700

Total

59,552

51,220

As at 30 June 2017 there was an allowance of impairment in trade and other receivables of the

Group of $0.114m (2016: $0.031m). The individually impaired items primarily relate to rental on

property where the lessees have fallen significantly behind on lease payments. Other receivables

past due but not considered impaired are nil (2016: nil).

(b) Credit risk (continued)

NOTE 11

FINANCIAL RISK MANAGEMENT (CONTINUED)

(ii) Credit quality

Allowance for impairment

The ageing analysis of trade receivables as at 30 June 2017 are listed below and include $8.7m

(2016: $19.4m) of trade receivables that are past due but not impaired. These relate to a number of

independent customers for whom there is no recent history of default. The $50.8m (2016: $31.8m)

of trade receivables is neither past due nor impaired and based on the credit history of these

customers it is expected that these amounts will be received when due.

The ageing of trade receivables is as follows: