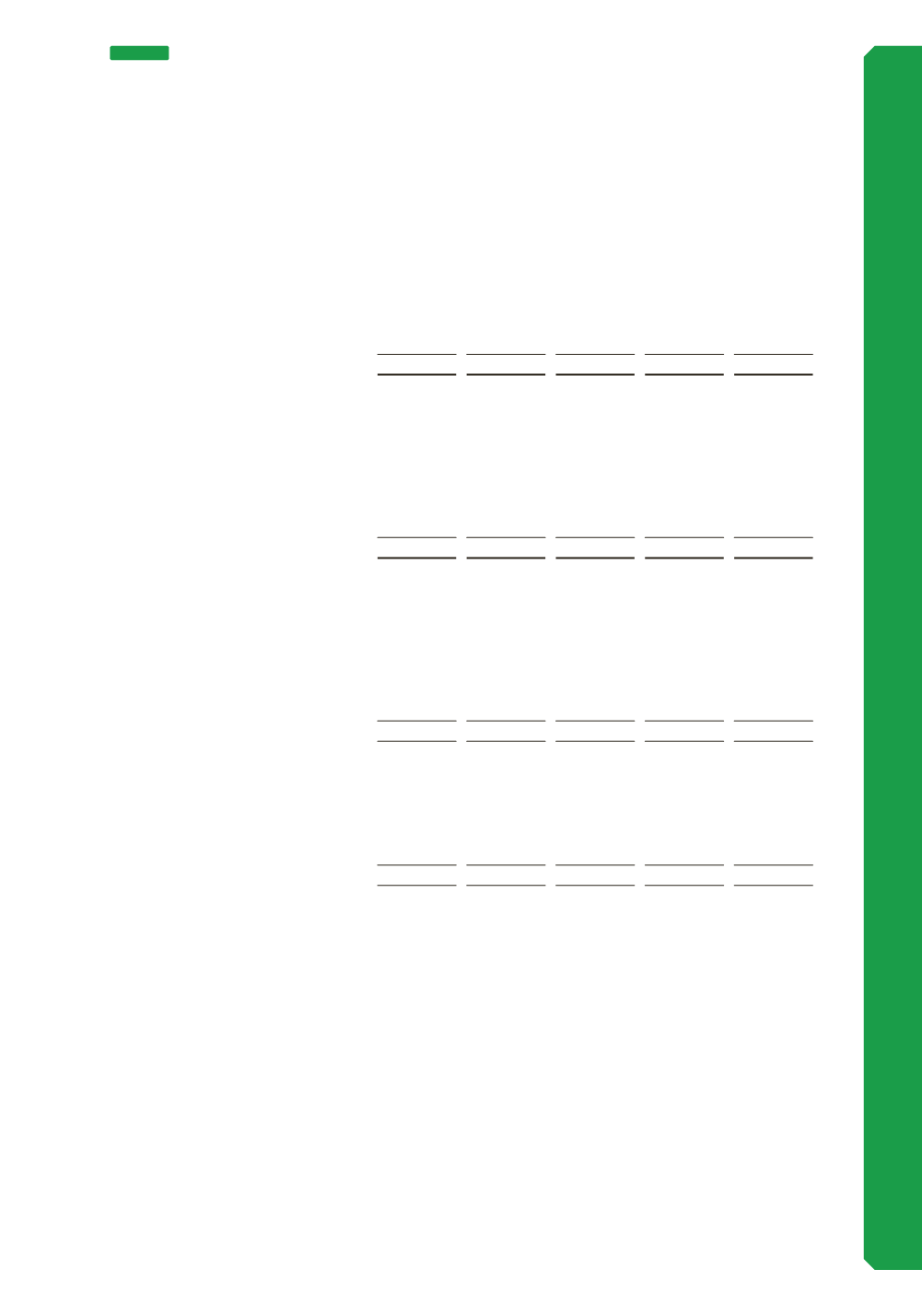

Less than

6 months

6 - 12

months

Between

1 and 5

years

Over 5

years

Total

cash-

flows

At 30 June 2017

$’000 $’000 $’000 $’000 $’000

Financial assets

Cash & cash equivalents

108,236

-

-

- 108,236

Trade & other receivables

72,001

42

374

271 72,688

Total financial assets

180,237

42

374

271 180,924

Financial liabilities

Trade & other payables

80,701

-

-

-

80,701

Bond issue

213,344 6,094 207,344 139,063 565,845

Borrowings

15,001

-

-

-

15,001

Derivatives financial liabilities -

foreign exchange

19

-

-

-

19

Other liabilities

110,415

6

49

442 110,912

Total financial liabilities

419,480 6,100 207,393 139,505 772,478

30 June 2016

Financial assets

Cash & cash equivalents

107,461

-

-

- 107,461

Trade & other receivables

64,066

34

367

340 64,807

Derivatives financial instruments -

foreign exchange

38

-

-

-

38

Total financial assets

171,565

34

367

340 172,306

Financial liabilities

Trade & other payables

82,001

-

-

-

82,001

Bond issue

13,344 13,444 421,156 144,688 592,532

Borrowings

145,333

-

-

- 145,333

Other liabilities

73,764

6

49

454 74,273

Total financial liabilities

314,442 13,350 421,205 145,142 894,139

(c) Liquidity risk (continued)

109

(d) Fair value measurements

(i) Fair value hierarchy and accounting classification

Judgements and estimates are made in determining the fair values of the items that are recognised

and measured at fair value in the financial statements. The reliability of the inputs used in determining

fair value, has been classified into the three levels prescribed under AASB 13. An explanation of each

level follows underneath the table.

NOTE 11

FINANCIAL RISK MANAGEMENT (CONTINUED)