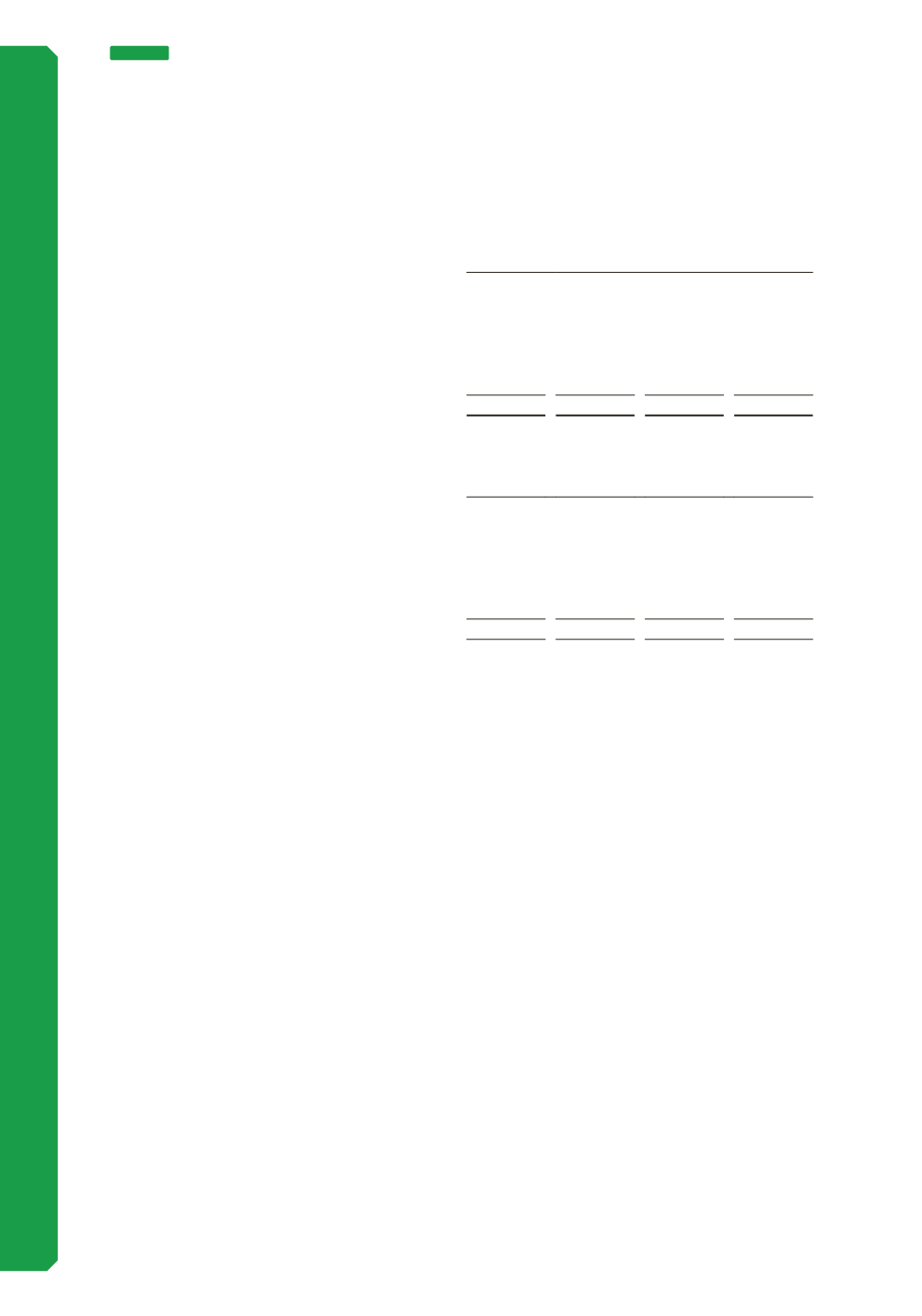

(iv) Sensitivity analysis - interest rate and foreign currency

Interest rate risk

-0.5%

+0.5%

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

30 June 2017

Financial assets

Cash and cash equivalents

(379)

(379)

379

379

Total increase/(decrease) in financial assets

(379)

(379)

379

379

Interest rate risk

-0.5%

+0.5%

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

30 June 2016

Financial assets

Cash and cash equivalents

(376)

(376)

376

376

Total increase/(decrease) in financial assets

(376)

(376)

376

376

This analysis assumes all other variables are constant. All current bonds are issued at fixed rates.

(a) Market risk (continued)

106

NOTE 11

FINANCIAL RISK MANAGEMENT (CONTINUED)

(b) Credit risk

(i) Risk management

The Group’s exposure to credit risk arises from potential default of the counterparty, with

a maximum exposure equal to the carrying amount. Credit risk is managed on a Group basis.

Credit risk arises predominantly from derivatives and trade and other receivables. The Group

does not hold any credit derivatives to offset its credit exposure.

The Group’s Treasury Policy outlines the approach to the management of counterparty credit risk

as approved by the Board. A number of criteria are utilised to manage and spread the level of risk

such as: minimum credit rating of counterparty (investment grade), maximum credit exposure to

any one counterparty and consideration of counterparty concentration risk.

The Group’s policy is that all customers enter into access agreements meeting the terms and

conditions as set out in the agreement before entering the Group’s rail network and receiving

any trade credit facilities.

The Group’s exposure to bad debts has been historically low and statistically insignificant, therefore

no collective loss provision is determined. The Group does have significant concentration of credit

risk associated with major customers providing a high proportion of access revenue, therefore any

bad debt provisions required are assessed on an individual basis.