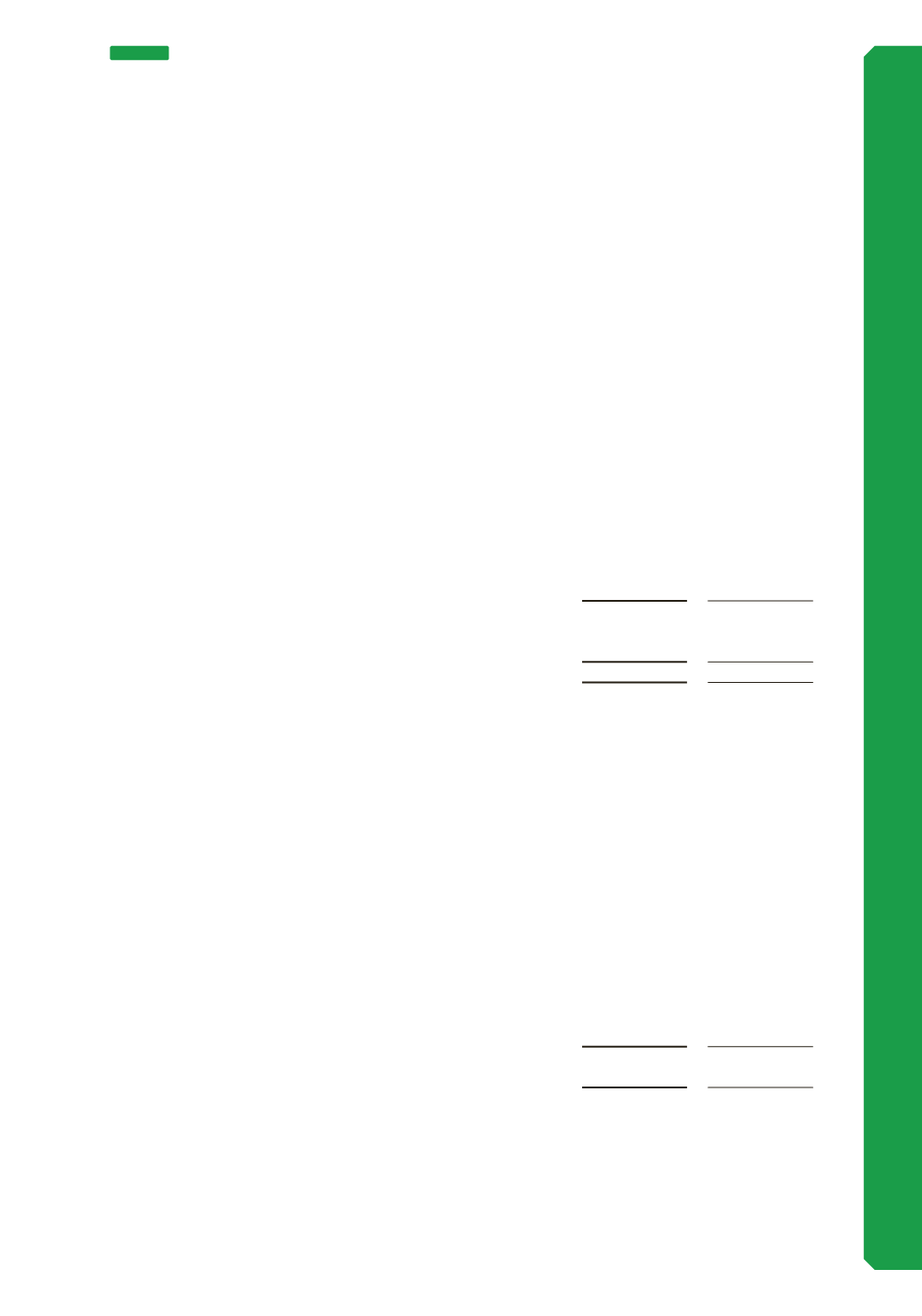

Consolidated

Notes

2017

$’000

2016

$’000

Total Borrowings

6(c), 6(d)

595,374

726,132

Less cash and cash equivalents

6(a)

(108,236)

(107,461)

Adjusted net debt

487,138

618,671

Total equity

3,514,344

3,490,429

Adjusted equity

4,001,482

4,109,100

Net debt to adjusted equity ratio

12.2%

15.1%

Total borrowings include trade and other payables and the impact of amortised interest and fees.

(b) Dividends - Ordinary shares

Consolidated

2017

$’000

2016

$’000

Final dividend for the year ended 30 June 2016

of 1.19 cents (2016: 1.03 cents) per fully paid share

29,893

26,770

Interim dividend for the year ended 30 June 2017

of 2.04 cents (2016: 2.48) per fully paid share

52,921

64,489

82,814

91,259

103

NOTE 10

CAPITAL MANAGEMENT

(a) Risk management

The Group’s objectives when managing capital are to:

•

•

safeguard the ability to continue as a going concern (refer to note 20(e)), so that they

can continue to provide returns for shareholders and benefits for other stakeholders, and

•

•

maintain an optimal capital structure to reduce the cost of capital.

In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends

paid to shareholders, return capital to shareholders, issue new shares or sell assets to reduce debt.

During 2017 the Group’s objective was to maintain a gearing ratio under 40% (2016: 50%).

The gearing ratios were as follows: