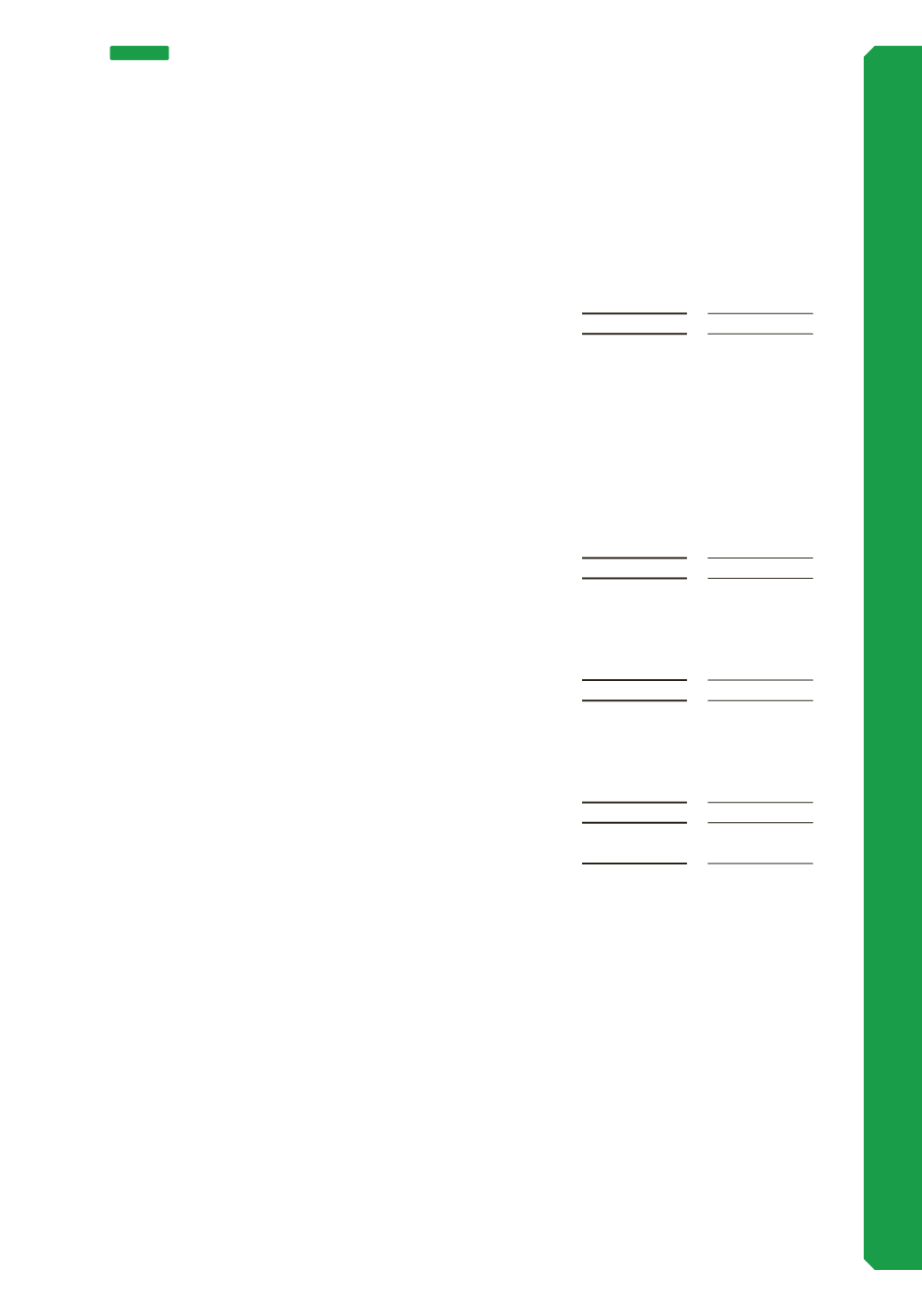

(b) Reserves

Consolidated

2017

$’000

2016

$’000

Asset revaluation reserve

693,520

792,678

Cash flow hedging reserve - foreign exchange

(9)

19

Profit reserves

270,815

231,148

964,326

1,023,845

Consolidated

2017

$’000

2016

$’000

Movements:

Revaluation surplus - Property, plant and equipment

Opening balance at 1 July

792,678

930,938

Revaluation on asset revaluation reserve - (net of tax)

(98,841)

(138,260)

Asset revaluation reserve - asset disposal

(317)

-

Balance as at 30 June

693,520

792,678

Profit reserve

Opening balance at 1 July

231,148

204,841

Profit transferred into the reserve

122,481

117,566

Dividend paid

(82,814)

(91,259)

Balance as at 30 June

270,815

231,148

Cash flow hedges

Opening balance at 1 July

19

(884)

Hedge liability - interest rate swap

-

884

Hedge reserve - foreign exchange

(28)

19

Balance as at 30 June

(9)

19

964,326

1,023,845

(i) Asset revaluation reserve

The property, plant and equipment revaluation reserve is used to record increments

and decrements on the revaluation of infrastructure assets.

(ii) Profit reserve

The profit reserve is used to preserve current profits for the purpose of paying dividends

in future years.

(iii) Hedge reserve - cash flow hedges

The hedging reserve comprises the effective portion of the cumulative net change in the fair

value of cash flow hedging instruments related to hedged transactions that have not yet occurred.

Amounts are reclassified to the consolidated income statement when the associated hedged

transaction settles.

101

NOTE 8

EQUITY (CONTINUED)