(vi) Defined benefit liability and employer

contributions

In accordance with the Occupational

Superannuation Standards Regulations

and Australian Accounting Standard AASB

1056 “Superannuation Entities” funding

arrangements are reviewed at least every

three years following the release of the

triennial actuarial review and was last

reviewed following completion of the triennial

review as at 30 June 2015. Contribution

rates are set after discussions between

the employer, STC and NSW Treasury.

The next triennial review is at 30 June 2018,

the report is expected to be released by the

end of 2018.

Funding positions are reviewed annually

and funding arrangements may be adjusted

as required after each annual review.

Expected contributions to defined benefit

plans for the year ending 30 June 2018 are

$1.4m. Following the triennial review of the

Defined Benefit Fund as at 30 June 2015 it

was determined that ARTC had an estimated

funding shortfall of approximately 12% that

the Trustees are endeavouring to recover

over the 3 year period from 1 July 2016 to 30

June 2019. The impact is that the employer

contribution will increase to $1.4m p.a. for

each of the next 3 years and be subject

to ongoing review.

The weighted average duration of the

defined benefit obligation is 12.9 years

(2016:16.8 years).

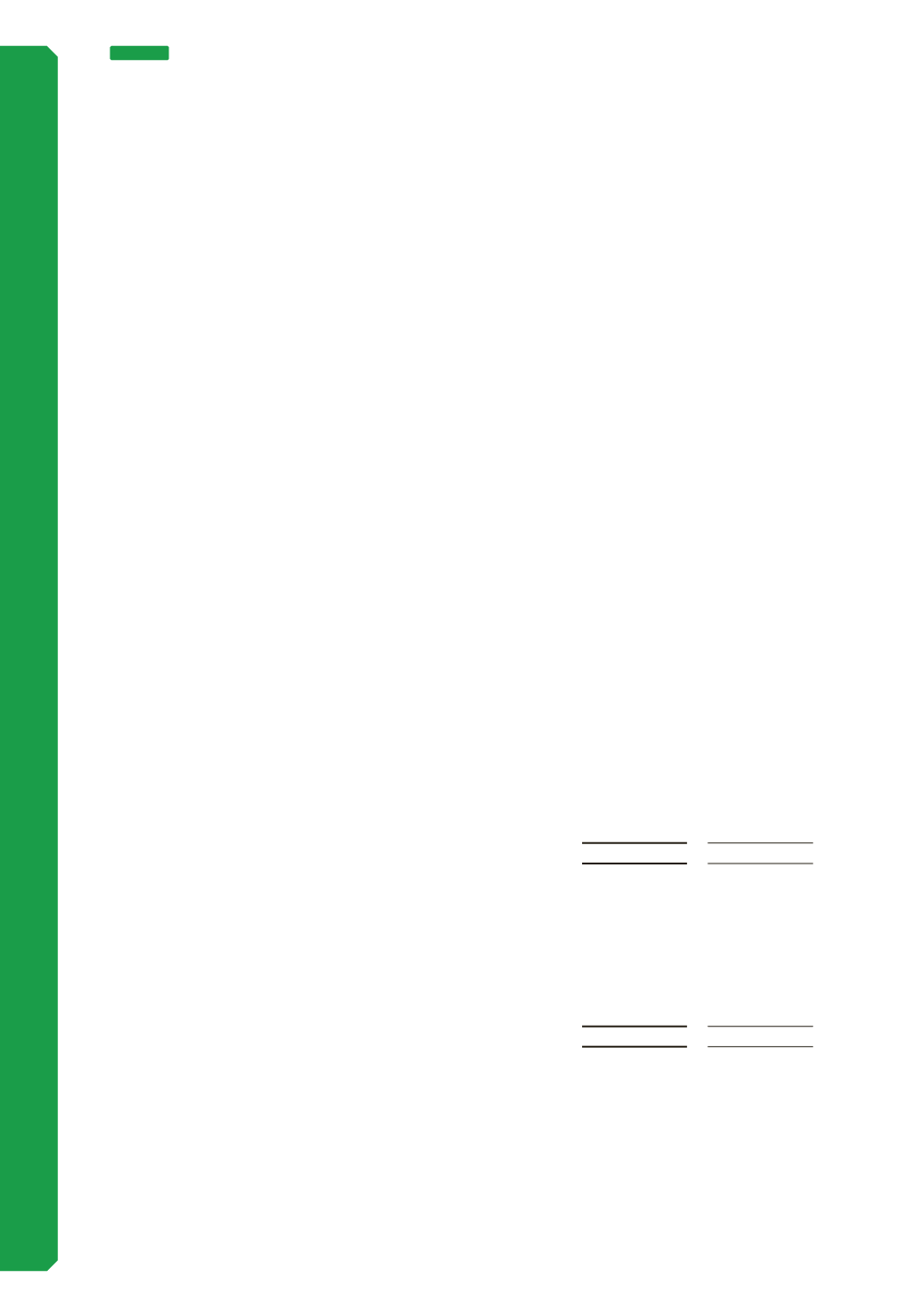

(g) Non-current liabilities - Defined benefit plans (continued)

NOTE 7

NON-FINANCIAL ASSETS AND LIABILITIES (CONTINUED)

Consolidated

2017

$’000

2016

$’000

Current service cost

571

535

Interest cost on benefit obligation

484

300

1,055

835

(viii) Amounts recognised in other comprehensive income

Consolidated

2017

$’000

2016

$’000

Actuarial (losses)/gains on liabilities

(1,446)

(7,174)

Actual return on Fund assets less interest income

(1,578)

(593)

(3,024)

(7,767)

(vii) Amounts recognised in consolidated income statement

The amounts recognised in the consolidated income statement in employee benefits

expense are as follows:

98