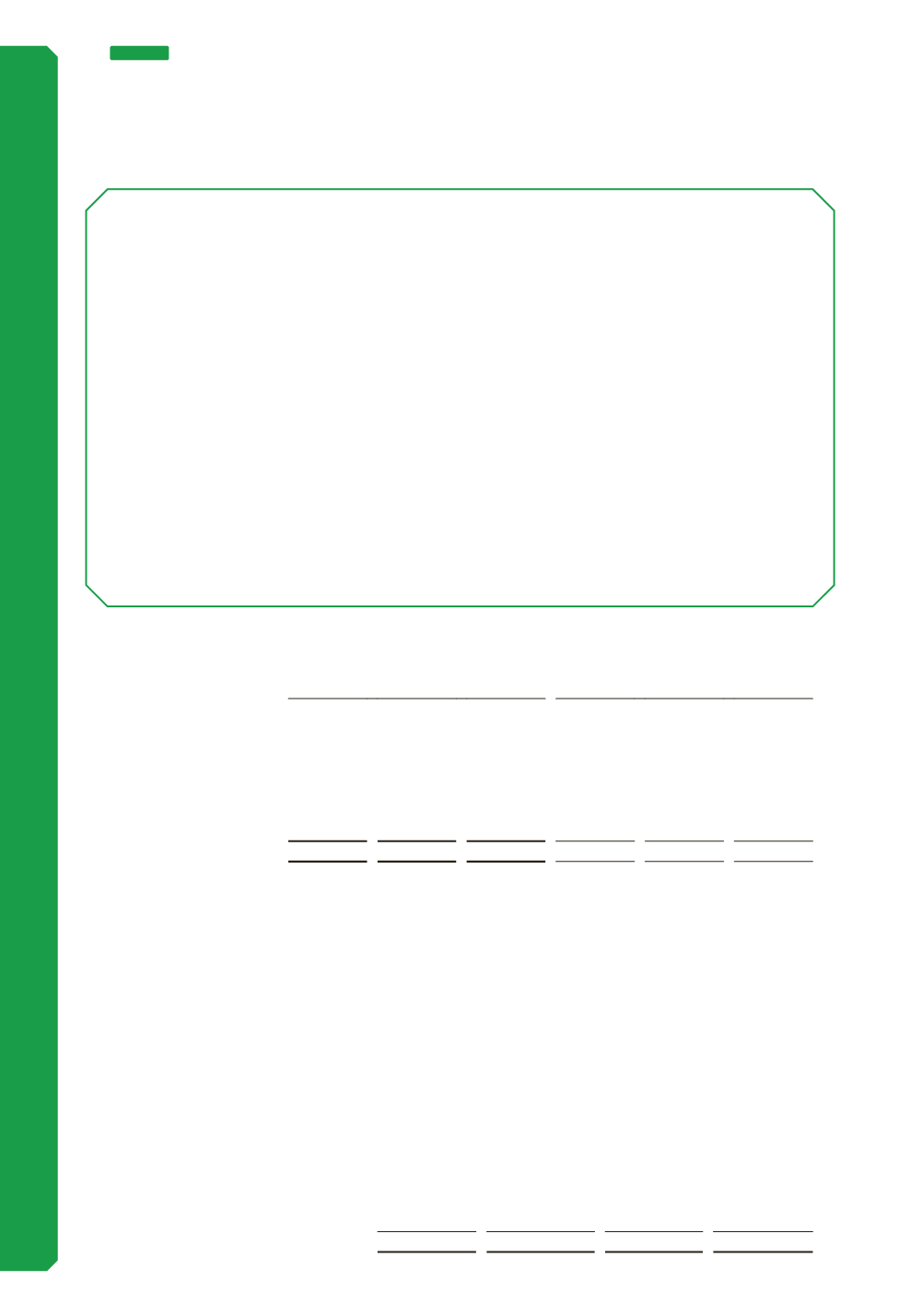

(f) Provisions

Consolidated

2017

2016

Current

$’000

Non-

current

$’000

Total

$’000

Current

$’000

Non-

current

$’000

Total

$’000

Employee benefits

40,187 4,393 44,580

39,826 3,888 43,714

Restructuring costs

-

-

-

550

-

550

Incident provision

15,750

- 15,750

8,115

-

8,115

55,937 4,393 60,330

48,491 3,888 52,379

(i) Information about individual provisions and significant estimates

The incident provision recognises the Group’s estimate of the liability with respect to costs

associated with damage caused by incidents such as derailments, which occurred whilst

using the Group’s rail infrastructure.

(ii) Movements in provisions

Movements in each class of provision during the financial year are set out below:

2017

Employee

benefits

$’000

Re-structure

obligation

$’000

Incident

$’000

Total

$’000

Carrying amount at 1 July

43,714

550

8,115

52,379

Additional provisions recognised

23,463

-

18,891

42,354

Amounts used during the year

(22,597)

(550)

(11,256)

(34,403)

Carrying amount at 30 June

44,580

-

15,750

60,330

(ii) Deferred tax liabilities (continued)

NOTE 7

NON-FINANCIAL ASSETS AND LIABILITIES (CONTINUED)

Tax consolidation

Australian Rail Track Corporation Ltd and its wholly owned Australian controlled entities consolidated

for income tax purposes as of 1 July 2003.

The head entity, Australian Rail Track Corporation Ltd and the controlled entities in the income tax

consolidated group continue to account for their own current and deferred tax amounts. The Group

has applied the stand alone taxpayer approach, consistent with the requirements of Interpretation

1052, in determining the appropriate amount of current taxes and deferred taxes to allocate to

members of the income tax consolidated group. In addition to its own current and deferred tax

amounts, Australian Rail Track Corporation Ltd also recognises the current tax liabilities (or assets)

and the DTAs arising from unused tax losses and unused tax credits assumed from controlled entities

in the tax consolidated group.

Assets or liabilities arising under tax funding agreements with the tax consolidated entities are

recognised as amounts receivable from or payable to other entities in the Group.

Any difference between the amounts assumed and amounts receivable or payable under the tax

funding agreement are recognised as a contribution to (or distribution from) wholly owned tax

consolidated entities.

92