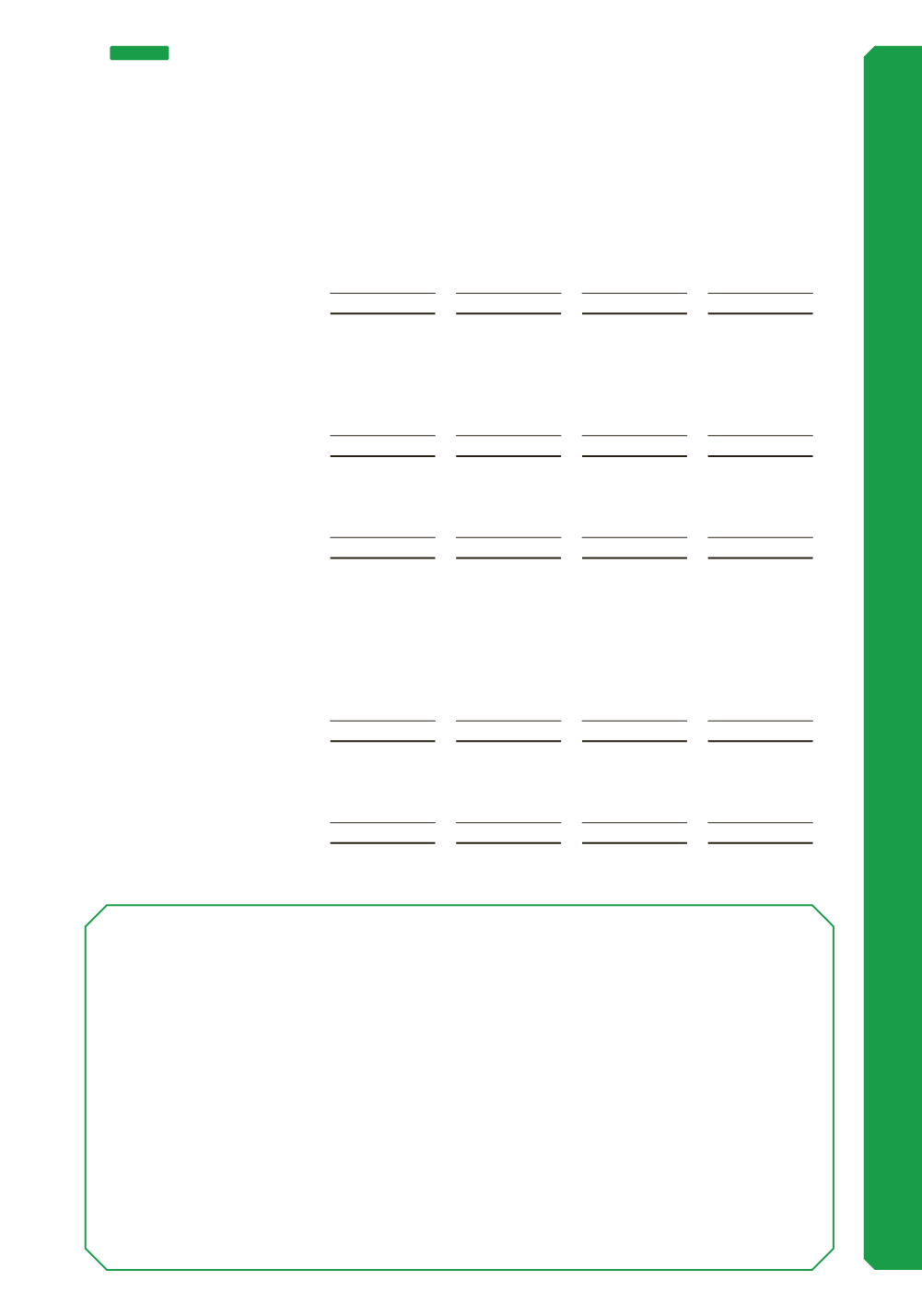

(d) Intangible assets

Computer

Software

$’000

Land Rights

$’000

Other

$’000

Total

$’000

Consolidated at 1 July 2015

Cost

19,762

42,378

55,000

117,140

Accumulated amortisation

(13,688)

(1,976)

(9,746)

(25,410)

Net book amount

6,074

40,402

45,254

91,730

Year ended 30 June 2016

Opening net book amount

as at 1 July

6,074

40,402

45,254

91,730

Additions into asset register

1,750

33

-

1,783

Amortisation charge

(2,355)

(825)

(3,772)

(6,952)

Closing net book amount

5,469

39,610

41,482

86,561

At 30 June 2016

Cost

14,491

42,411

55,000

111,902

Accumulated amortisation

(9,022)

(2,801)

(13,518)

(25,341)

Net book amount

5,469

39,610

41,482

86,561

Consolidated year ended

30 June 2017

Opening net book amount as

at 1 July

5,469

39,610

41,482

86,561

Additions into asset register

3,109

148

-

3,257

Amortisation charge

(2,754)

(945)

(3,773)

(7,472)

Transfers from land

-

2,175

-

2,175

Closing net book amount

5,824

40,988

37,709

84,521

At 30 June 2017

Cost

17,600

44,735

55,000

117,335

Accumulated amortisation

(11,776)

(3,747)

(17,291)

(32,814)

Net book amount

5,824

40,988

37,709

84,521

Note impairment is not applicable on the above assets.

Accounting policy

Intangible assets

Computer software has a finite useful life and is carried at cost less accumulated amortisation.

Amortisation is calculated using the straight line method to allocate the cost of computer software

over its estimated useful life of four years.

ARTC recognises land usage rights when costs are incurred to obtain land which ARTC does not

retain title but through leasing rights has the ability to utilise the land. Under lease arrangements,

ARTC may provide funds to other bodies to acquire additional land holdings to enable the

infrastructure to be expanded. ARTC is not entitled to be reimbursed for this expenditure but has the

right to use the land. The land rights have a finite useful life expiring in conjunction with the relevant

lease and are carried at cost less accumulated amortisation. Amortisation is calculated using the

straight line method to allocate the cost of land rights over its estimated useful life.

89

NOTE 7

NON-FINANCIAL ASSETS AND LIABILITIES (CONTINUED)