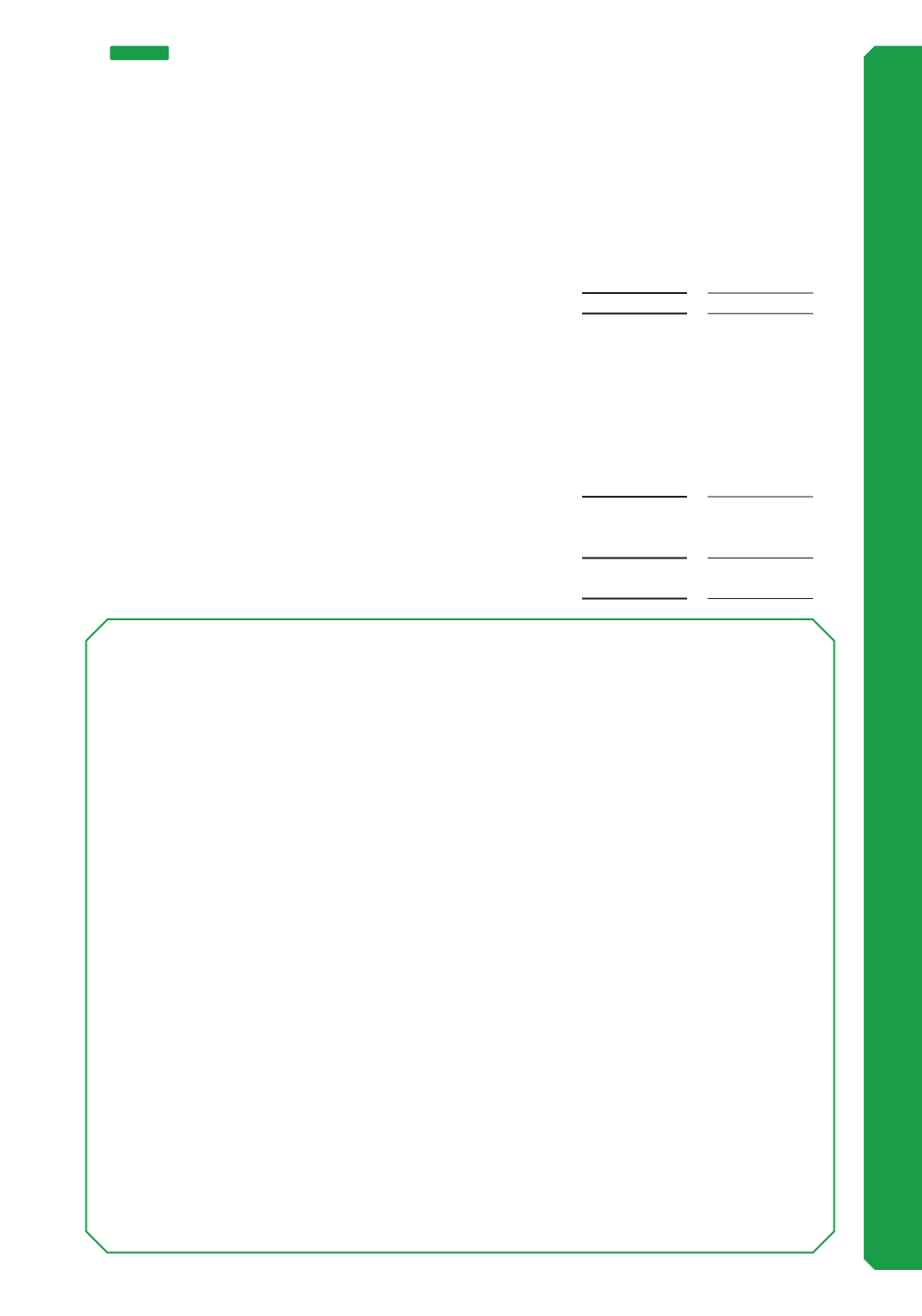

Consolidated

2017

$’000

2016

$’000

The balance comprises temporary differences attributable to:

Property, plant and equipment

158,299

193,700

Other receivables

2,173

3,012

Deferred tax liabilities

160,472

196,712

Movements:

Opening balance at 1 July

196,712

290,478

Charged/(credited) to the consolidated income statement related

to property, plant and equipment

8,303

(29,336)

Charged/(credited) to the consolidated income statement related

to other receivables

(839)

(1,345)

Charged/(credited) to equity related to property, plant and

equipment

(43,704)

(63,085)

Closing balance at 30 June before set off

160,472

196,712

Set off to deferred tax assets

(160,472)

(196,712)

Net deferred tax liability

-

-

(ii) Deferred tax liabilities

Accounting policy

Income tax

Current tax assets and liabilities for the current and prior periods are measured at the amount

expected to be recovered from or paid to the taxation authorities based on the current periods

taxable income and any adjustments in respect of prior years. The tax rates and tax laws used to

compute the amount are those that are enacted or substantively enacted by the reporting date.

Deferred tax liabilities (DTLs) are recognised for all taxable temporary differences between the

carrying amount of assets and liabilities for financial reporting and the amounts used for taxation

purposes.

Deferred tax assets (DTAs) are recognised for all deductible temporary differences, carry forward of

unused tax offsets and unused tax losses, to the extent that it is probable that taxable profit will be

available against which the deductible temporary differences and the unused tax offsets and losses

can be utilised.

Division 58 of the Income Tax Assessment Act 1997 (“Division 58”), has entitled the Group to value

certain assets, for taxation purposes, using pre-existing audited book values or the notional written

down values of the assets as appropriate. This effectively means the tax depreciable value of these

rail infrastructure and related assets significantly exceeds the carrying value. Accordingly, Division 58

results in significant deductible temporary differences and potential DTAs. The carrying amount of

DTAs is reviewed at each reporting date and adjusted to the extent that it is probable that sufficient

taxable profit will be available to allow the deferred tax asset to be utilised.

DTAs and DTLs are measured at the tax rates that are expected to apply in the year when the asset

is realised or the liability is settled, based on tax rates (and tax laws) that have been enacted or

substantively enacted at the reporting date. DTAs and DTLs are offset only if a legally enforceable

right exists to set off current tax assets against current tax liabilities and the DTAs and DTLs relate to

the same taxable entity and the same taxation authority.

91

NOTE 7

NON-FINANCIAL ASSETS AND LIABILITIES (CONTINUED)