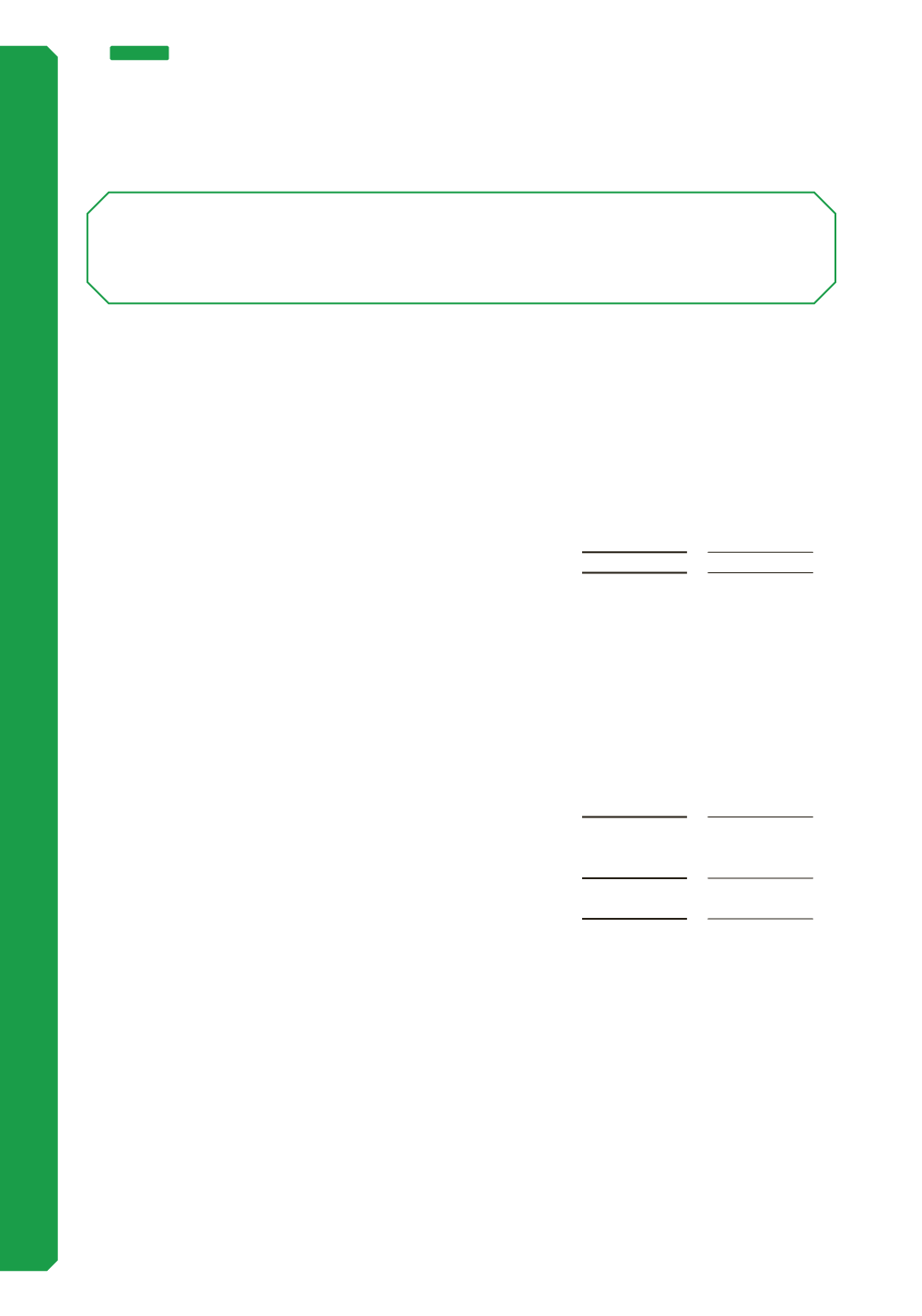

Consolidated

2017

$’000

2016

$’000

The balance comprises temporary differences attributable to:

Property, plant and equipment

348,323

367,274

Income tax losses and non-refundable offsets

1,851

3,765

Defined benefit plan

3,321

4,340

Other current assets

31

-

353,526

375,379

Movements:

Opening balance at 1 July

375,379

482,158

(Charged)/credited to the consolidated income statement related

to tax losses and offsets

(1,914)

716

(Charged)/credited to the consolidated income statement related

to property plant and equipment

(17,607)

(105,641)

(Charged)/credited to the consolidated income statement, other

(93)

33

(Charged)/credited to equity related to property, plant and

equipment

(1,344)

(3,830)

Credited /(Charged) to equity related to defined benefit plan

(907)

2,330

(Charged)/credited related to cash flow hedge

12

(387)

Closing balance at 30 June before set off

353,526

375,379

Set off of deferred tax liabilities

(160,472)

(196,712)

Net deferred tax asset

193,054

178,667

(i) Deferred tax assets

(e) Deferred tax balances

At 30 June 2017, the Group has unrecognised deferred tax assets in relation to temporary differences

of $247.4m (2016: $265.0m) associated with the Group’s ability to claim tax depreciation on

NSW lease assets utilising Division 58 of the Income Tax Assessment Act 1997 and also due to the

impairment of the assets of the North South rail corridor.

The Group has an unrecognised deferred tax asset in relation to a carried forward capital loss of

$0.7m (2016: $0.7m). It is not recognised on the basis that there are no forecast future capital gains

against which the loss could be utilised.

(d) Intangible assets (continued)

Other intangible assets relate to contractual rights in relation to a wholesale access agreement which

provides a pricing cap over the third party infrastructure asset between Kalgoorlie and Perth which

completes track access between the east and west coast of Australia.

90

NOTE 7

NON-FINANCIAL ASSETS AND LIABILITIES (CONTINUED)