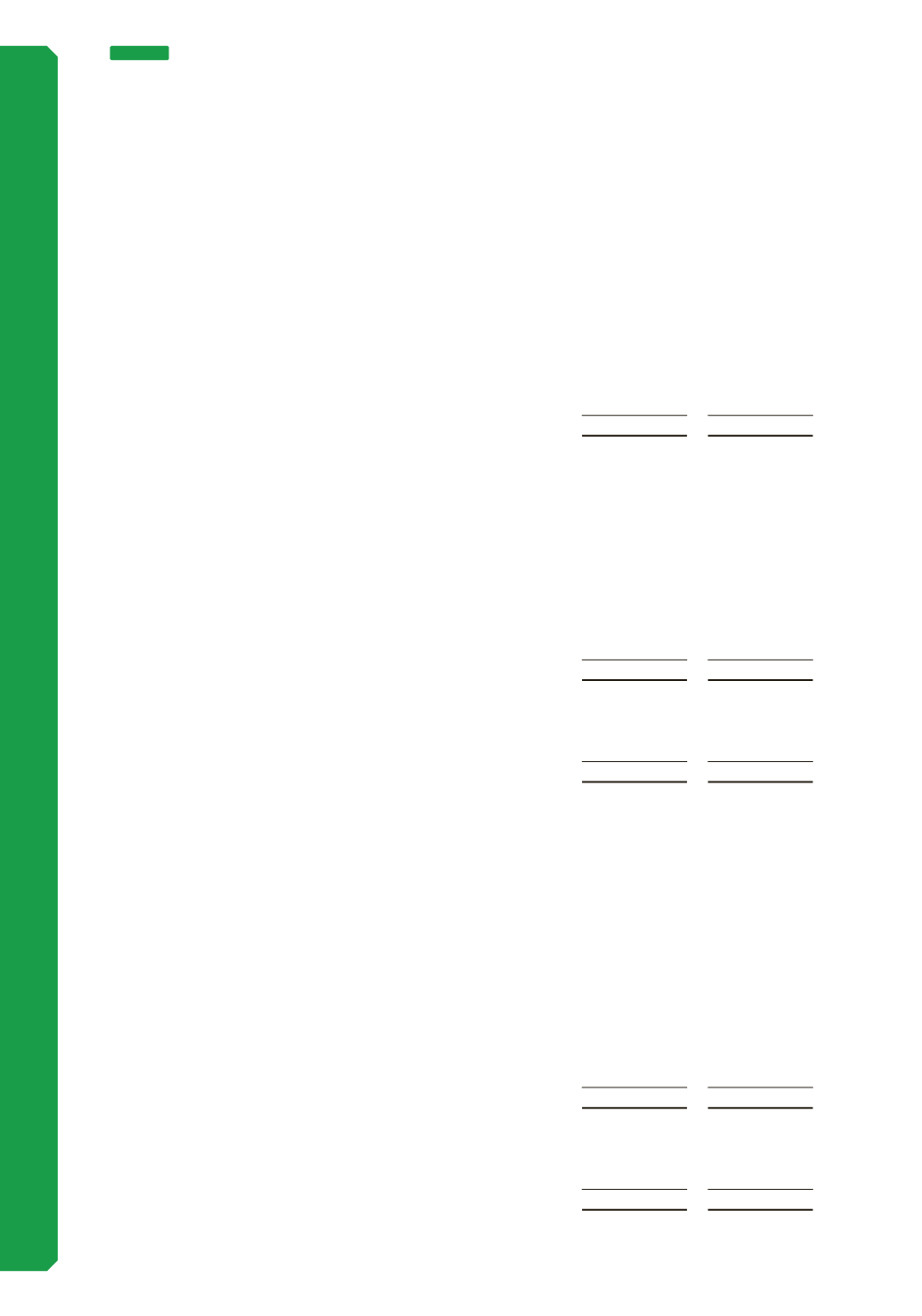

Construction

in progress

Freehold

land

Consolidated

$’000

$’000

At 1 July 2015

Cost or fair value

245,605

7,302

Accumulated depreciation

-

-

Net book amount

245,605

7,302

Year ended 30 June 2016

Opening net book amount

245,605

7,302

Additions

-

95

Reversal of impairment expense

-

-

Borrowing costs capitalised

1,962

-

Additions into capital works in progress

189,061

-

Depreciation charge

-

-

Transfers out of capital work in progress

(183,770)

-

Written down value of assets disposed

-

-

Reversal of revaluation of assets

-

-

Closing net book amount

252,858

7,397

At 30 June 2016

Cost or fair value

252,858

7,397

Accumulated depreciation

-

-

Net book amount

252,858

7,397

(c) Property, plant and equipment

Non - Current Assets

Consolidated

Year ended 30 June 2017

Opening net book amount

252,858

7,397

Additions

-

16,088

Transfers to properties held for sale

-

(2,776)

Impairment expense

-

(2,100)

Borrowing costs capitalised

3,326

-

Additions into capital works in progress

253,540

-

Depreciation charge

-

-

Transfers out of capital work in progress

(220,678)

-

Written down value of assets disposed

-

-

Revaluation of assets

-

-

Transfer to land usage rights

-

(2,175)

Closing net book amount

289,046

16,434

At 30 June 2017

Cost or valuation

289,046

16,434

Accumulated depreciation

-

-

Net book amount

289,046

16,434

84

NOTE 7

NON-FINANCIAL ASSETS AND LIABILITIES (CONTINUED)