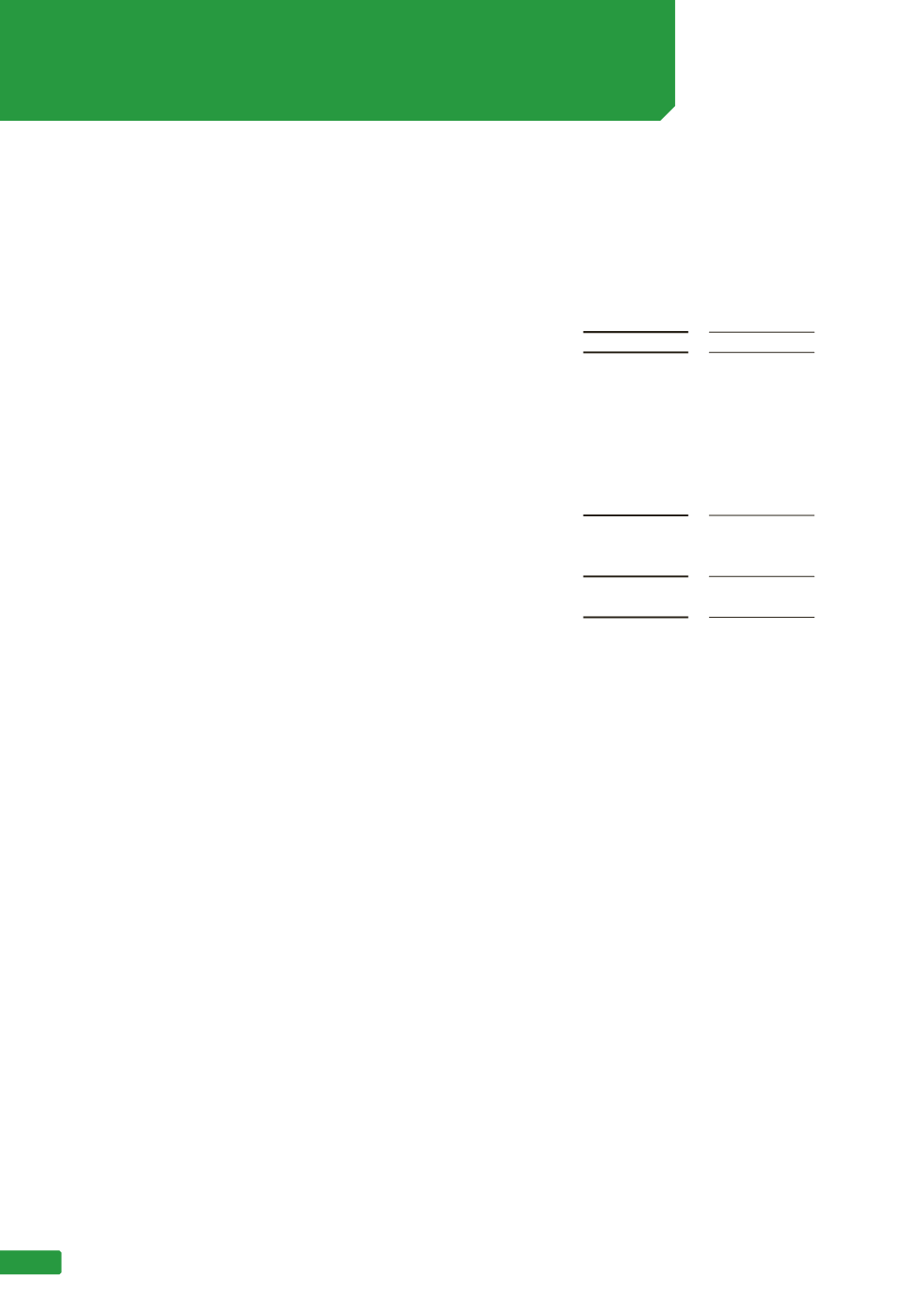

Consolidated

2016

$’000

2015

$’000

The balance comprises temporary differences attributable to:

Property, plant and equipment

193,700

286,121

Other receivables

3,012

4,357

Deferred tax liabilities

196,712

290,478

Movements:

Opening balance at 1 July

290,478

305,412

(Credited)/charged to equity related to property, plant and

equipment

(63,085)

11,999

(Credited)/charged to the consolidated income statement related

to property, plant and equipment

(29,336)

(31,290)

Other receivables

(1,345)

4,357

Closing balance at 30 June before set off

196,712

290,478

Set off of deferred tax liabilities

(196,712)

(290,478)

Net deferred tax liability

-

-

(ii) Deferred tax liabilities

NOTE 8 (CONTINUED)

NON-FINANCIAL ASSETS AND LIABILITIES

(c) Deferred tax balances (continued)

70