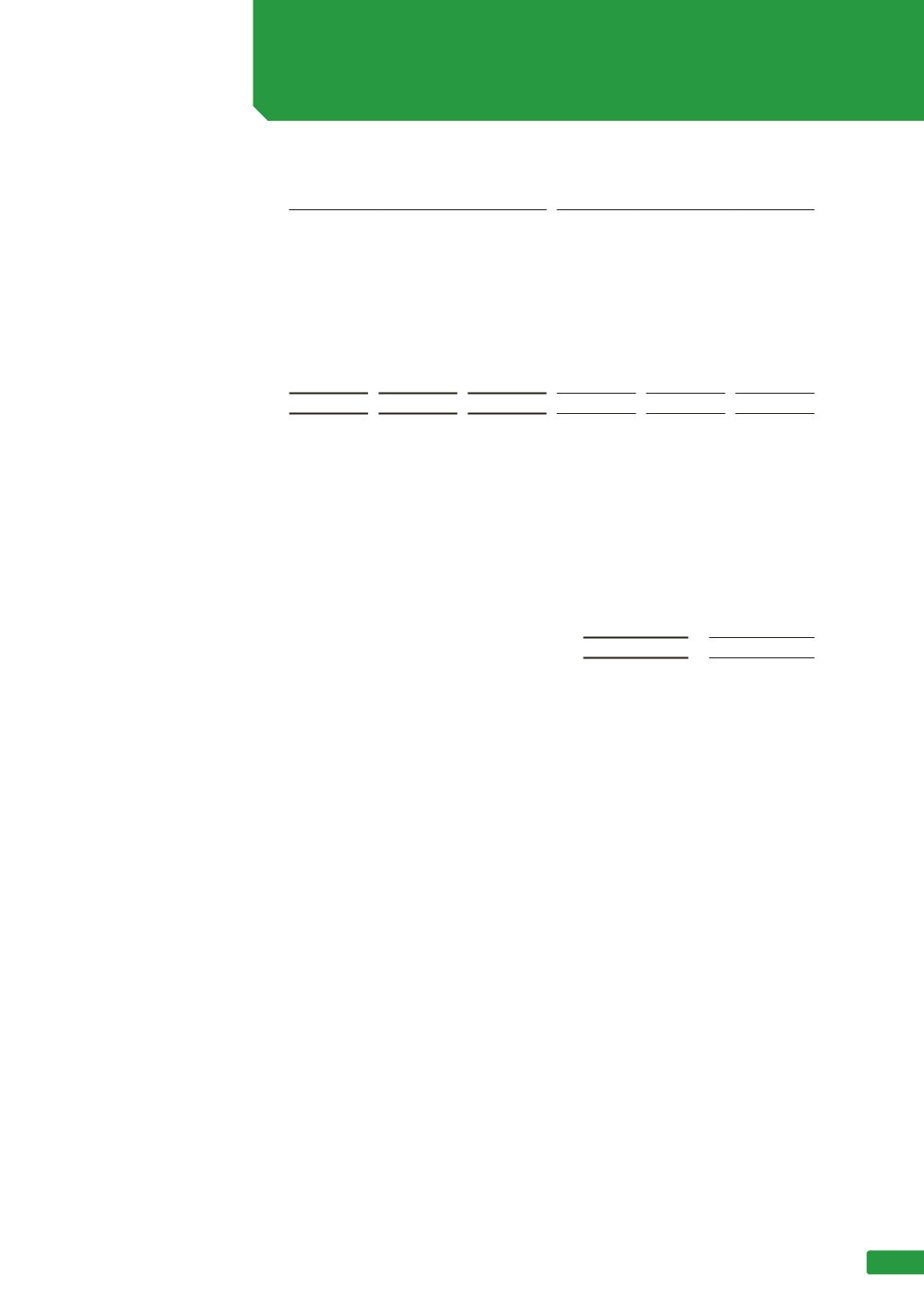

Consolidated

2016

Consolidated

2015

The major category

of plan assets are as

follows:

Quoted

$m

Un-

quoted

$m

Total

$m

Quoted

$m

Un-

quoted

$m

Total

$m

Equity instruments

18,198 3,617 21,815

19,862 3,656 23,518

Property

1,113 2,537 3,650

949 2,504 3,453

Short term securities

2,044

6 2,050

96 2,546 2,642

Fixed interest securities

1 3,554 3,555

1 3,659 3,660

Other assets

471 6,645 7,116

622 6,548 7,170

21,827 16,359 38,186

21,530 18,913 40,443

Consolidated

2016

%

2015

%

Equity instruments

57

58

Property

10

9

Short term securities

5

6

Fixed interest securities

9

9

Other assets

19

18

100

100

(iv) Actuarial assumptions and sensitivity

Actuarial assessment undertaken by Mercer as at 30 June 2016 contains the following significant

independent actuarial assumptions (expressed as weighted averages):

Consolidated

2016

2015

Discount rate

3.6%

4.6%

Rate of CPI increase

2.4%

2.5%

Future salary increases

3.1%

3.1%

The sensitivity of the total defined benefit obligation as at 30 June 2016 under several scenarios is

shown below.

Scenarios related to changes to the discount rate, salary growth rate and rate of CPI increase relate

to sensitivity of the total defined benefit obligation to economic assumptions, and scenarios related

to pensioner mortality relate to sensitivity to demographic assumptions. The assumption as to the

expected rate of return on assets is determined by weighing the expected long term return for each

asset class by the target allocation of assets to each class. The returns used for each class are net

of investment tax and investment fees.

NOTE 8 (CONTINUED)

NON-FINANCIAL ASSETS AND LIABILITIES

75