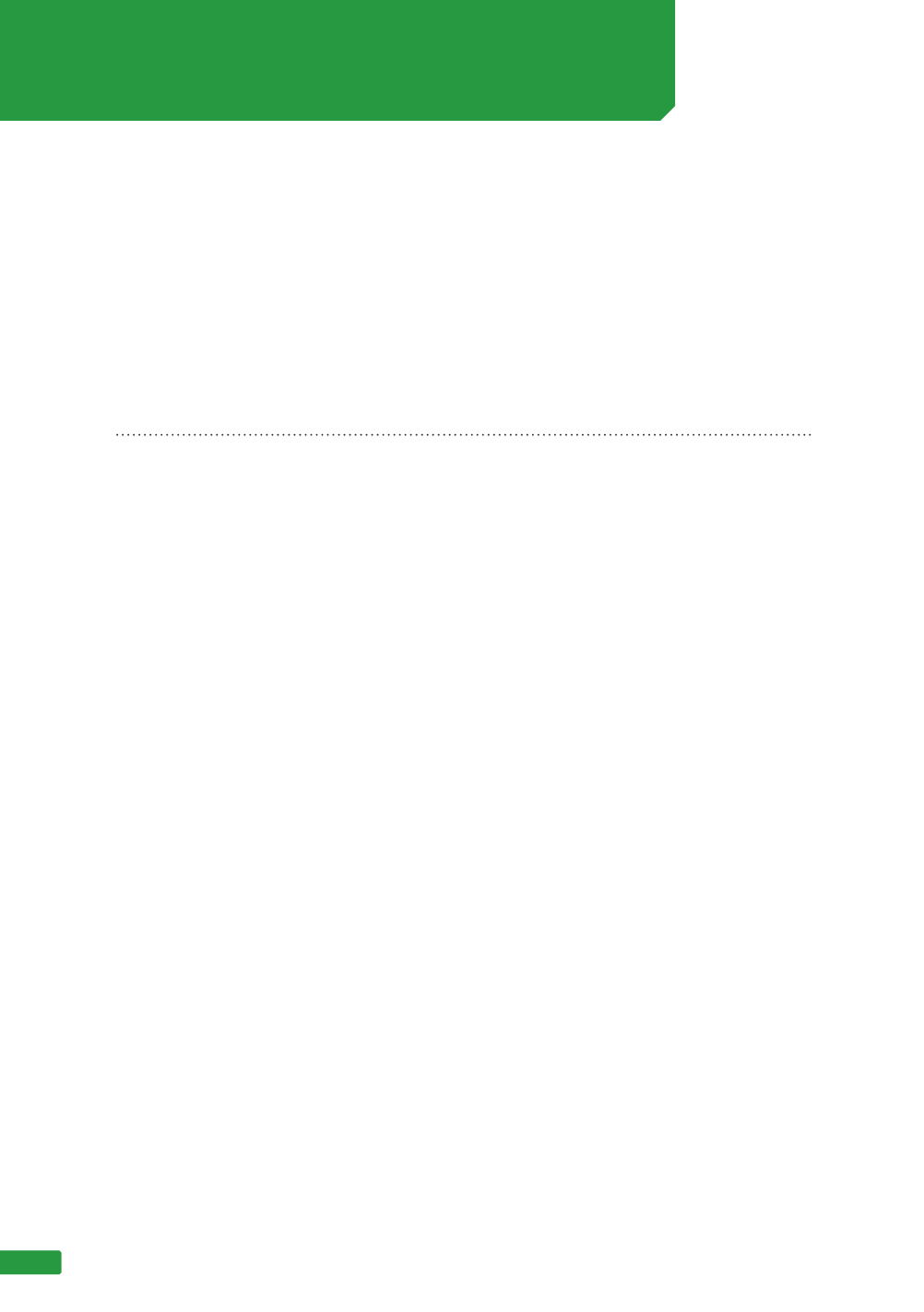

Impact on defined benefit

Change in

assumption

Increase in

assumption

Decrease in

assumption

2016

2015

2016

2015

$’000

$’000

$’000

$’000

Discount rate

1.0%

4,209 3,343 (5,196)

(4,092)

Salary growth rate

0.5% (1,248)

(1,174)

1,190 1,118

Rate of CPI increase

0.5% (1,096)

(669)

1,000

608

Pensioner mortality rate

5.0%

175

105 (420)

(110)

The defined benefit obligation has been

recalculated by changing the assumptions

as outlined above, whilst retaining all other

assumptions.

(v) Risk exposure

There are a number of risks to which the Fund

exposes the Employer. The more significant

risks relating to the defined benefits are:

•

•

Investment risk - The risk that investment

returns will be lower than assumed

and the Employer will need to increase

contributions to offset this shortfall.

•

•

Longevity risk - The risk that pensioners

live longer than assumed, increasing future

pensions.

•

•

Pension indexation risk - The risk that

pensions will increase at a rate greater

than assumed, increasing future pensions.

•

•

Salary growth risk - The risk that wages or

salaries (on which future benefit amounts

for active members will be based) will rise

more rapidly than assumed, increasing

defined benefit amounts and thereby

requiring additional employer contributions.

•

•

Legislative risk - The risk is that legislative

changes could be made which increase the

cost of providing the defined benefits.

The defined benefit fund assets are invested

with independent fund managers and have

a diversified asset mix. The Fund has no

significant concentration of investment risk

or liquidity risk.

(vi) Defined benefit liability and

employer contributions

In accordance with the Occupational

Superannuation Standards Regulations

and Australian Accounting Standard 25

“Financial Reporting by Superannuation Plans”

funding arrangements are reviewed at least

every three years following the release of

the triennial actuarial review and was last

reviewed following completion of the triennial

review as at 30 June 2015. Contribution

rates are set after discussions between the

employer, STC and NSW Treasury.

The next triennial review is at 30 June 2018,

the report is expected to be released by the

end of 2018.

Funding positions are reviewed annually and

funding arrangements may be adjusted as

required after each annual review.

Expected contributions to defined benefit

plans for the year ending 30 June 2017 are

$1.4m. Following the triennial review of the

Defined Benefit Fund as at 30 June 2015 it

was determined that ARTC had an estimated

funding shortfall of approximately 12% that

the Trustees are endeavouring to recover

over the 3 year period from 1 July 2016 to 30

June 2019. The impact is that the employer

contribution will increase to $1.4m p.a. for

each of the next 3 years and be subject to

ongoing review.

The weighted average duration of the defined

benefit obligation is 16.8 years (2015:12.2 years).

(iv) Actuarial assumptions and sensitivity

NOTE 8 (CONTINUED)

NON-FINANCIAL ASSETS AND LIABILITIES

(f) Non-current liabilities - Defined benefit plans (continued)

76