NOTE 7 (CONTINUED)

INCOME TAX EXPENSE/(BENEFIT)

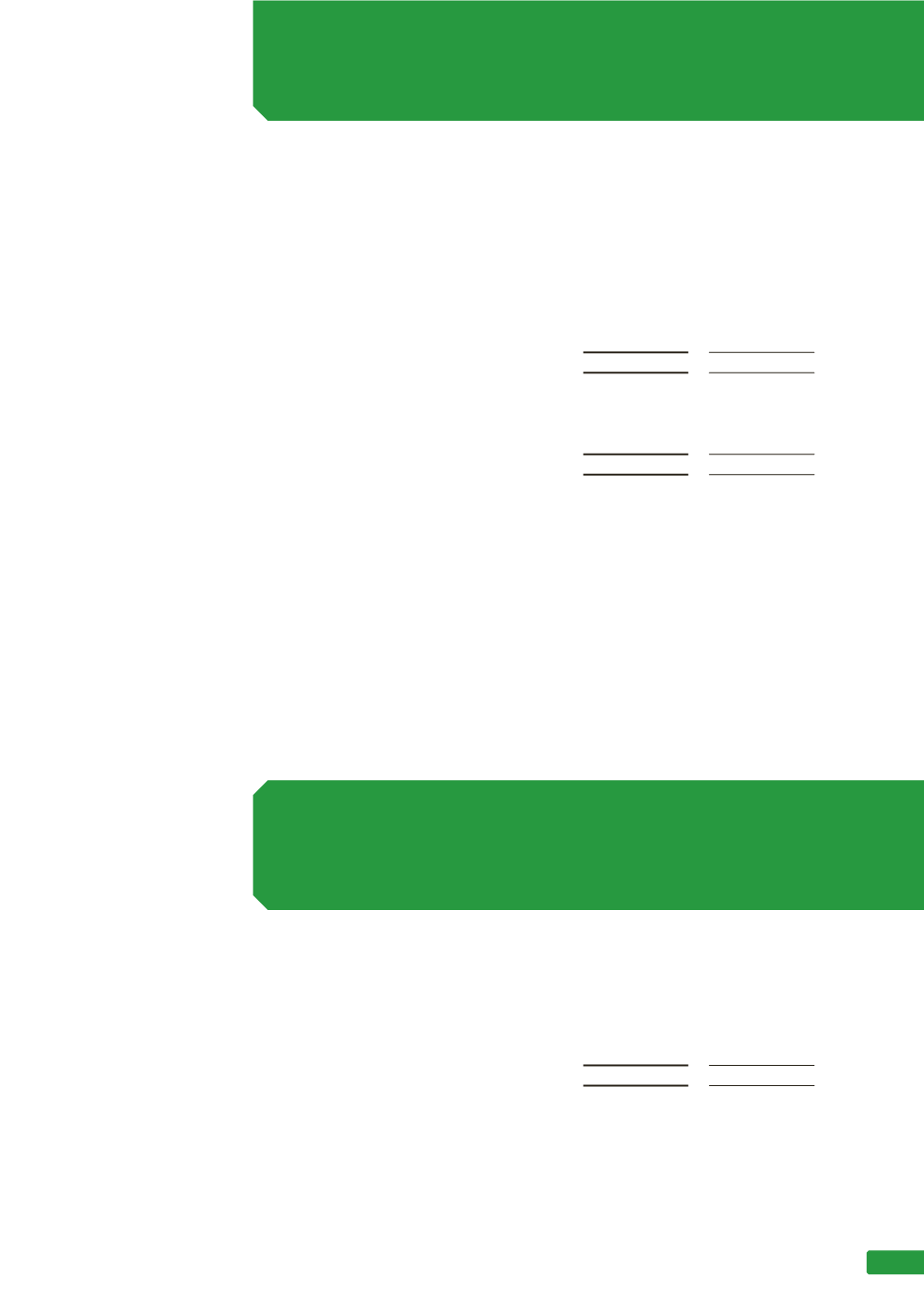

(c) Amounts charged or credited directly to equity

Consolidated

2016

$’000

2015

$’000

Deferred income tax related to items charged directly to equity

Net (loss)/gain on revaluation of infrastructure assets

(59,254)

(18,727)

Net (loss)/gain on defined benefit plan

(2,330)

1,576

Net gain on interest rate swap

377

557

Net gain on foreign exchange hedge

9

-

(61,198)

(16,594)

Deferred income tax charge included in equity comprises:

(Decrease)/increase in deferred tax liabilities

(63,085)

11,999

(Increase)/decrease in deferred tax assets

1,887

(28,593)

(61,198)

(16,594)

The income tax charged directly to equity of ($59.3m) (2015: ($18.7m)) is the tax effect of the

reversal of revaluations of ($197.5m) (2015: $62.4m), see note 8(b). The income tax charged

directly to equity of ($2.3m) (2015: $1.6m) is the tax effect of the defined benefit amount included

in other comprehensive income ($7.7m) (2015: $5.3m), see note 8(f).

(d) Tax consolidation legislation

Australian Rail Track Corporation Ltd and its wholly owned Australian controlled entities consolidated

for income tax purposes as of 1 July 2003. The accounting policy in relation to this legislation is set

out in note 21(k).

NOTE 8

NON-FINANCIAL ASSETS AND LIABILITIES

(a) Inventories

Consolidated

2016

$’000

2015

$’000

Current assets

Raw materials - at cost

29,094

30,553

29,094

30,553

65