The prior year deemed cost amount of Plant and Equipment and Leasehold Improvements has been

restated to include the impact of 2015 depreciation expense on revalued assets which had previously

been omitted. This is a disclosure change only and there is no impact to the actual carrying value as

reported on the balance sheet nor the depreciation recognised in the income statement.

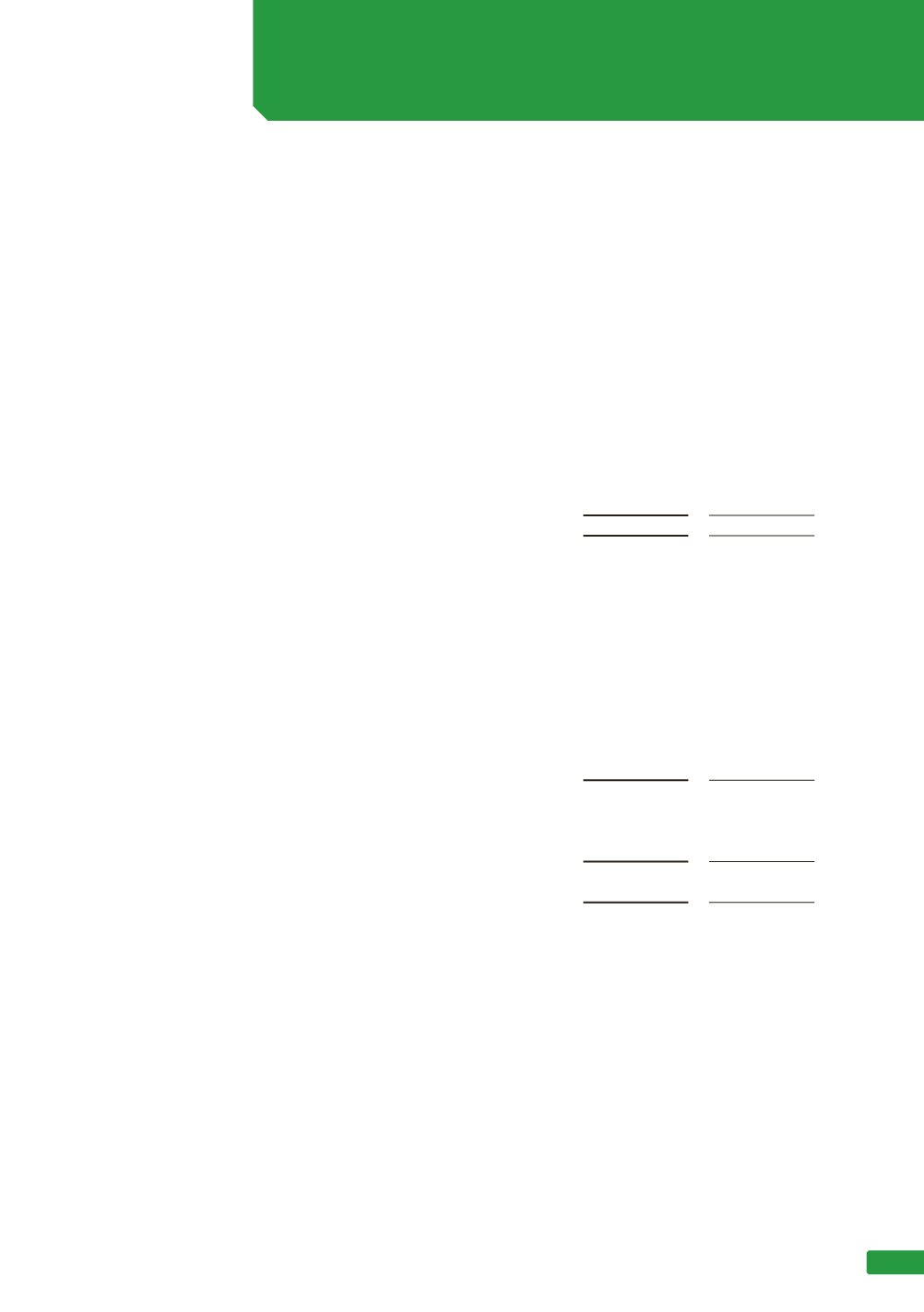

(c) Deferred tax balances

(i) Deferred tax assets

Consolidated

2016

$’000

2015

$’000

The balance comprises temporary differences attributable to:

Property plant and equipment

367,274

476,745

Income tax losses and non-refundable offsets

3,765

3,049

Defined benefit plan

4,340

1,985

Cash flow hedges - interest rate swap and foreign exchange

-

379

375,379

482,158

Movements:

Opening balance at 1 July

482,158

533,936

(Charged)/credited to the consolidated income statement related

to tax losses and offsets

716

(17,841)

(Charged)/credited to the consolidated income statement related

to property plant and equipment

(105,641)

(63,263)

(Charged)/credited to equity related to property, plant and

equipment

(3,830)

30,725

Credited /(Charged) to equity related to defined benefit plan

2,330

(1,576)

(Charged)/credited related to cash flow hedge

(387)

(557)

Adjustments for movements through income statement

33

734

Closing balance at 30 June before set off

375,379

482,158

Set off of deferred tax liabilities

(196,712)

(290,478)

Net deferred tax asset

178,667

191,680

At 30 June 2016, the Group has unrecognised deferred tax assets of $265.0m (2015: $248.4m)

associated with provisions, deferred government grant income assessable on receipt for tax

purposes and property, plant & equipment. The deductible temporary differences in relation to

property, plant & equipment exist as a result of the Group’s ability to claim tax depreciation on NSW

lease assets utilising Division 58 of the Income Tax Assessment Act 1997 and the impairment of the

assets of the Interstate business unit.

The Group has an unrecognised deferred tax asset in relation to a carried forward capital loss of

$0.7m (2015: $0.7m). It is not recognised on the basis that there are no forecast future capital gains

against which the loss could be utilised.

NOTE 8 (CONTINUED)

NON-FINANCIAL ASSETS AND LIABILITIES

69