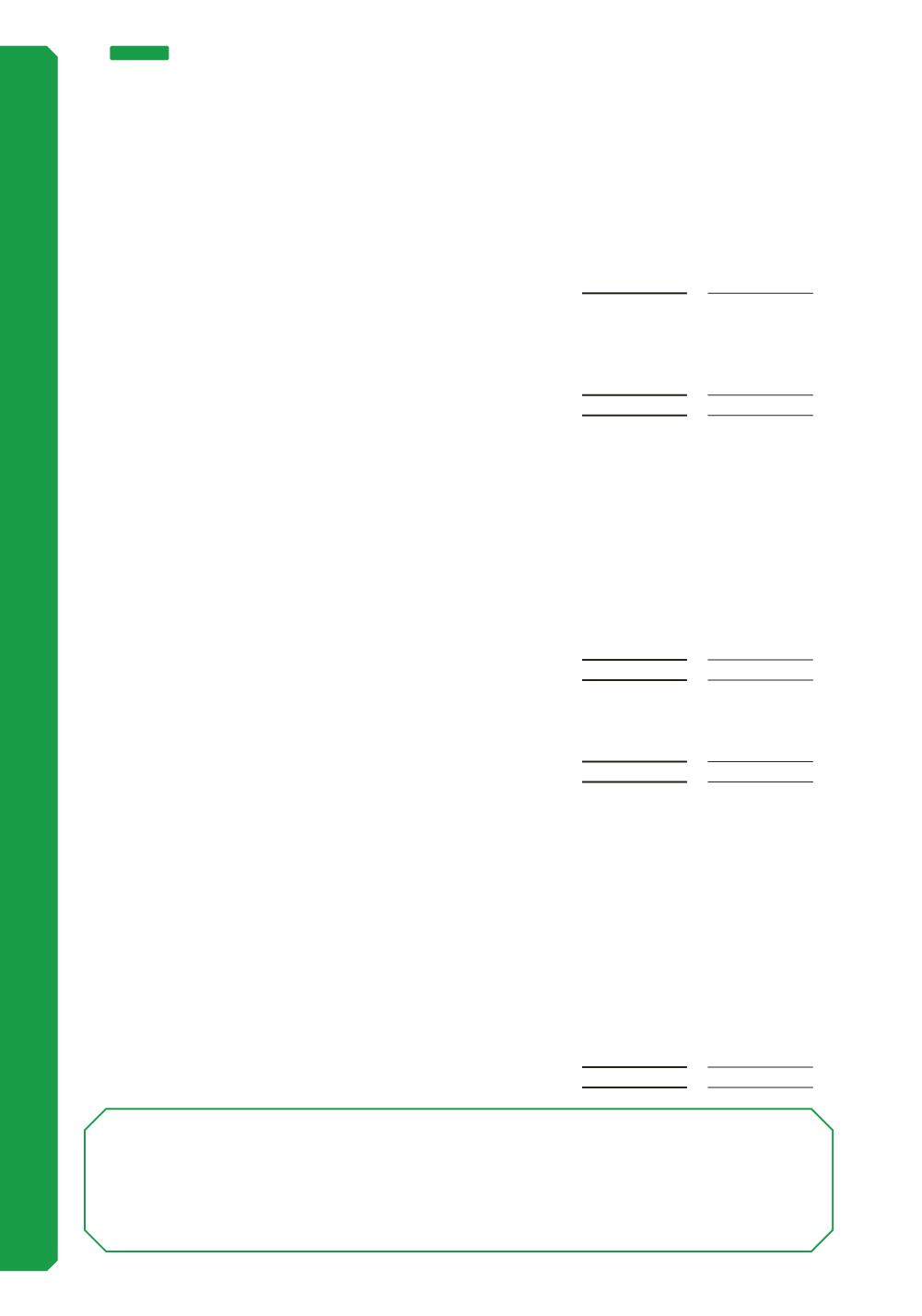

Consolidated

2017

$’000

2016

$’000

Profit from continuing operations before income tax expense

149,559

191,778

Tax at the Group's statutory tax rate of 30%

44,868

57,533

Unrecognised temporary differences

(17,667)

16,624

Amendments and prior year adjustments

(25)

170

Research and development income tax offset

(127)

(135)

Non-taxable items

29

20

Total income tax expense

27,078

74,212

Consolidated

2017

$’000

2016

$’000

Deferred income tax related to items charged directly to equity

Net (loss)/gain on revaluation of infrastructure assets

(42,360)

(59,254)

Net (loss)/gain on defined benefit plan

907

(2,330)

Net gain on interest rate swap

-

377

Net gain on foreign exchange hedge

(12)

9

(41,465)

(61,198)

Deferred income tax charge included in equity comprises:

(Decrease)/increase in deferred tax liabilities

(43,704)

(63,085)

(Increase)/decrease in deferred tax assets

2,239

1,887

(41,465)

(61,198)

The income tax charged directly to equity of $42.4m (2016: ($59.3m) is the tax effect of the

reversal of revaluations of $141.2m (2016: $197.5m), see note 7(c). The income tax charged directly

to equity of $0.9m (2016:$2.3m) is the tax effect of the defined benefit amount included in other

comprehensive income $3.0m (2016: $7.7m), see note 7(g).

Consolidated

2017

$’000

2016

$’000

Impairment - property, plant and equipment (refer to note 7(c))

1,082

(3,015)

impairment - shares held at cost

19

-

1,101

(3,015)

Accounting Policy

Impairment

Accounting policies for impairment refer to note 7(c).

(h) Numerical reconciliation of income

tax expense/(benefit) to prima facie

tax payable

(i) Amounts charged or credited

directly to equity

(j) (Reversal) / recognition of impairment

80

NOTE 5

INCOME AND EXPENSES (CONTINUED)