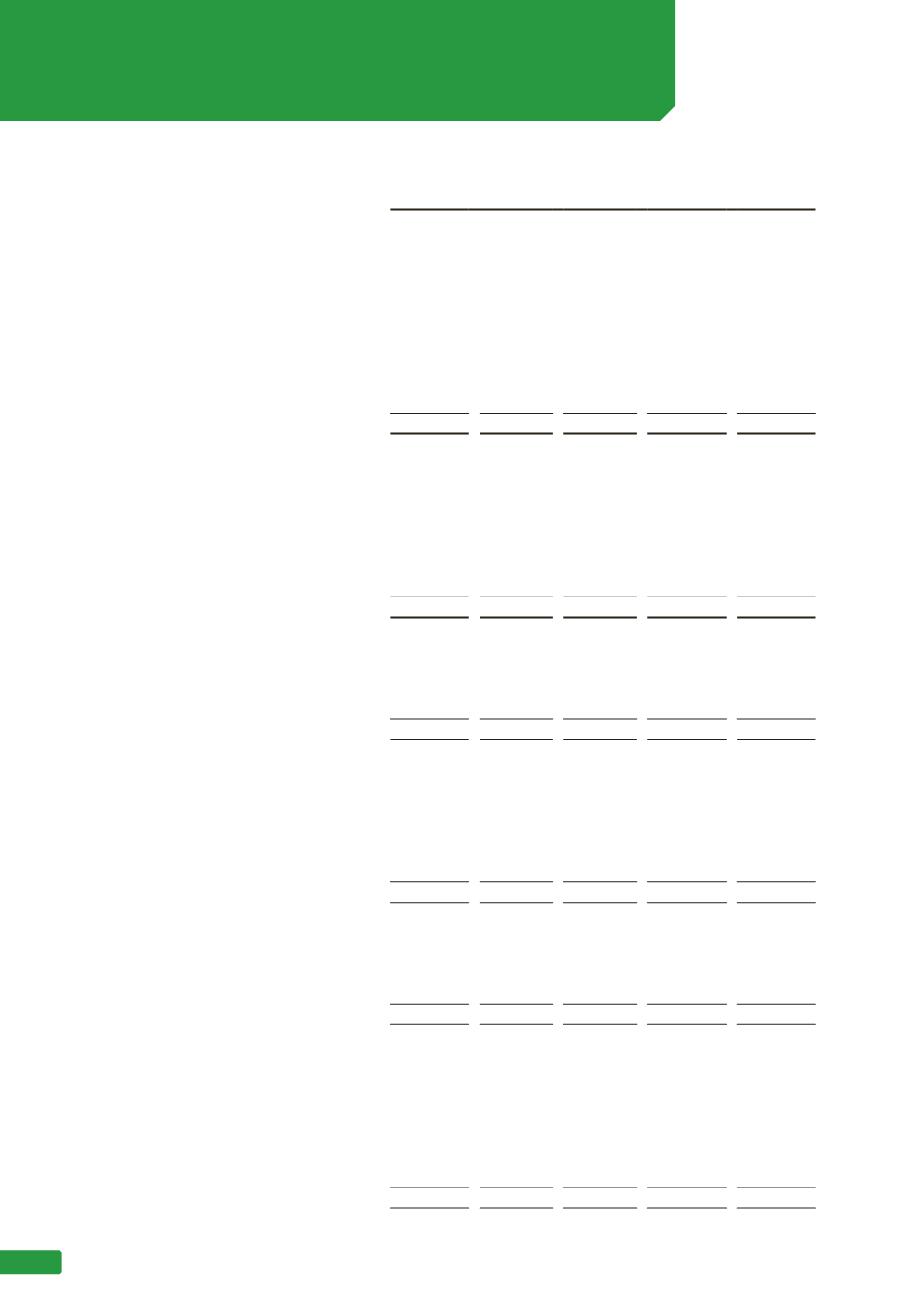

Fair Value

30 June 2016

Notes

Carrying

Value

$’000

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

Non-financial assets

Designated at fair value

Leasehold improvements -

infrastructure assets

8(b) 3,349,009

-

- 3,349,009 3,349,009

Plant & equipment -

infrastructure assets

8(b)

675,835

675,835 675,835

Total non-financial assets

4,024,844

-

- 4,024,844 4,024,844

Financial assets

Fair value - hedging instruments

Foreign exchange forward

contracts used for hedging 12(a)

38

-

38

-

38

Loans and receivables

Trade and other receivables 6(b)

64,807

-

-

-

64,807

Cash and cash equivalents 6(a)

107,461

-

-

- 107,461

Total financial assets

172,306

-

38

- 172,306

Financial liabilities

Other financial liabilities

Interest bearing liabilities

6(d)

644,131

-

-

- 644,131

Trade payables

6(c)

82,001

-

-

-

82,001

Total financial liabilities

726,132

-

-

- 726,132

30 June 2015

Non-financial assets

Designated at fair value

Infrastructure assets

8(b) 3,552,353

-

- 3,552,353 3,552,353

Plant & equipment -

infrastructure assets

8(b)

669,731

-

- 669,731 669,731

Total non-financial assets

4,222,084

-

- 4,222,084 4,222,084

Financial assets

Loans and receivables

Trade and other receivables 6(b)

61,425

-

-

-

61,425

Cash and cash equivalents 6(a)

319,937

-

-

- 319,937

Total financial assets

381,362

-

-

- 381,362

Financial liabilities

Fair value - hedging instruments

Interest rate swaps used for

hedging

12(a)

1,262

-

1,262

-

1,262

Other financial liabilities

Interest bearing liabilities

6(d) 1,010,853

-

-

- 1,010,853

Trade payables

6(c)

88,978

-

-

-

88,978

Total financial liabilities

1,101,093

-

1,262

- 1,101,093

NOTE 12 (CONTINUED)

FINANCIAL RISK MANAGEMENT

(d) Fair value measurements (continued)

88