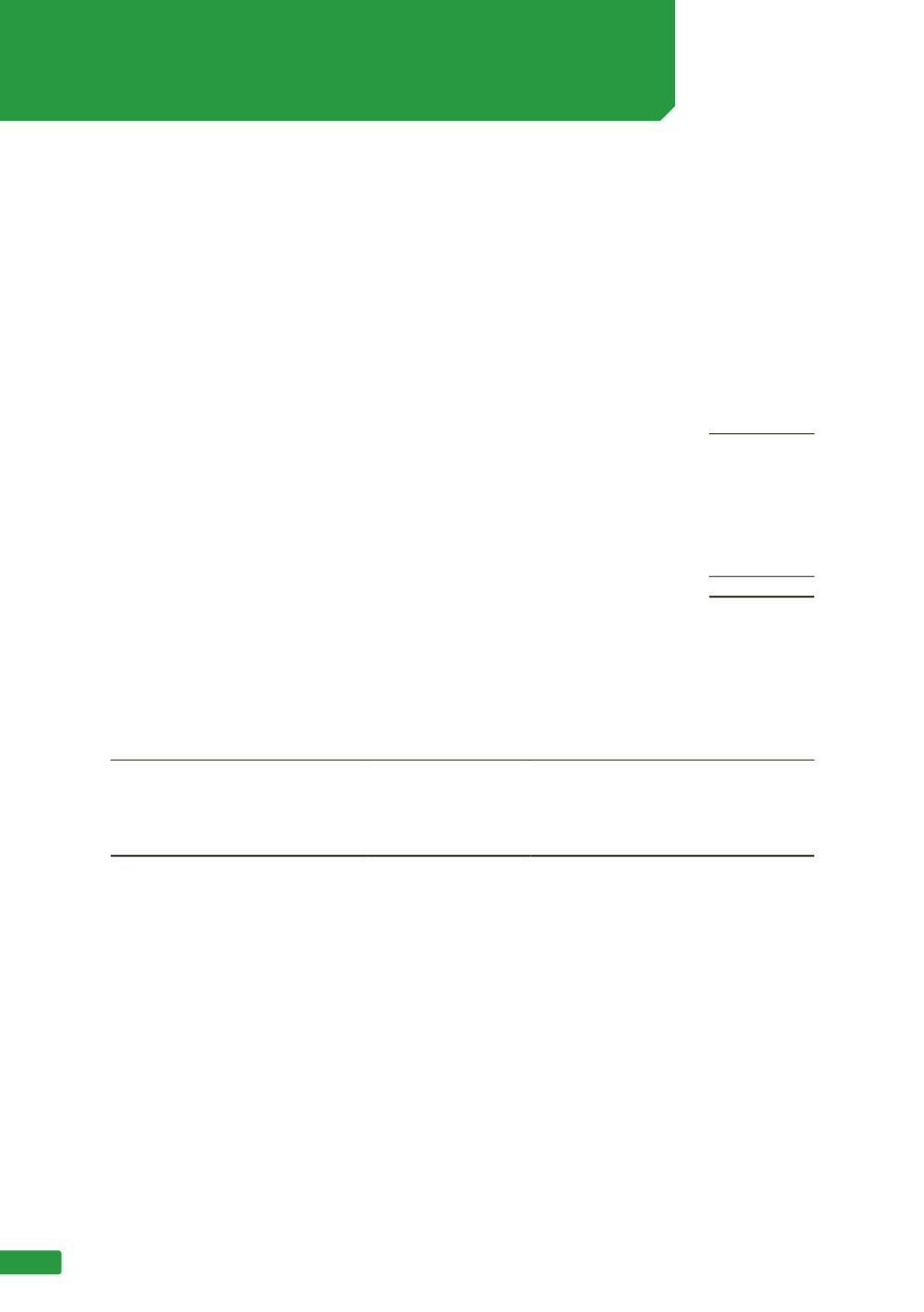

$’000

Opening balance 1 July 2014

4,077,219

Additions

401,236

Loss included in expenses

(25,525)

Depreciation

(168,424)

Changes in fair value included in other comprehensive income

(62,422)

Closing balance 30 June 2015

4,222,084

Additions

173,359

Gain included in expenses

3,015

Depreciation

(176,093)

Disposals

(7)

Change in fair value included in other comprehensive income

(197,514)

Closing balance 30 June 2016

4,024,844

(iv) Valuation inputs and relationships to fair value

The following table summarises the information about the significant unobservable inputs used in

level 3 fair value infrastructure asset measurements. See (ii) above for the valuation techniques

adopted.

Valuation technique

Significant

unobservable

inputs

Inter-relationship between

significant unobservable inputs

and fair value measurements

Discounted cash flows:

The valuation model considers

the present value of expected

payment, discounted using a

risk-adjusted discount rate.

The expected payment is

determined by considering

the cashflow forecasts for

each business unit which is

comprised of the relevant CGUs.

Risk adjustments are made and

terminal value calculations are

completed on a probability basis.

Forecast

annual revenue,

Maintenance and

capital expenditure,

Risk-adjusted

discount rate

The estimated fair value would

increase (decrease) if; the annual

revenue growth rate were higher

(lower), if maintenance and capital

expenditure were lower (higher);

or the risk-adjusted discount rate

were lower (higher). Generally a

change in the annual revenue growth

rate is accompanied by a directionally

similar change in maintenance and

capital expenditure.

(iii) Fair value measurements using significant unobservable inputs (level 3)

The following table presents the changes in level 3 items for the periods ended 30 June 2015 and 30

June 2016 for the Group:

NOTE 12 (CONTINUED)

FINANCIAL RISK MANAGEMENT

(d) Fair value measurements (continued)

90