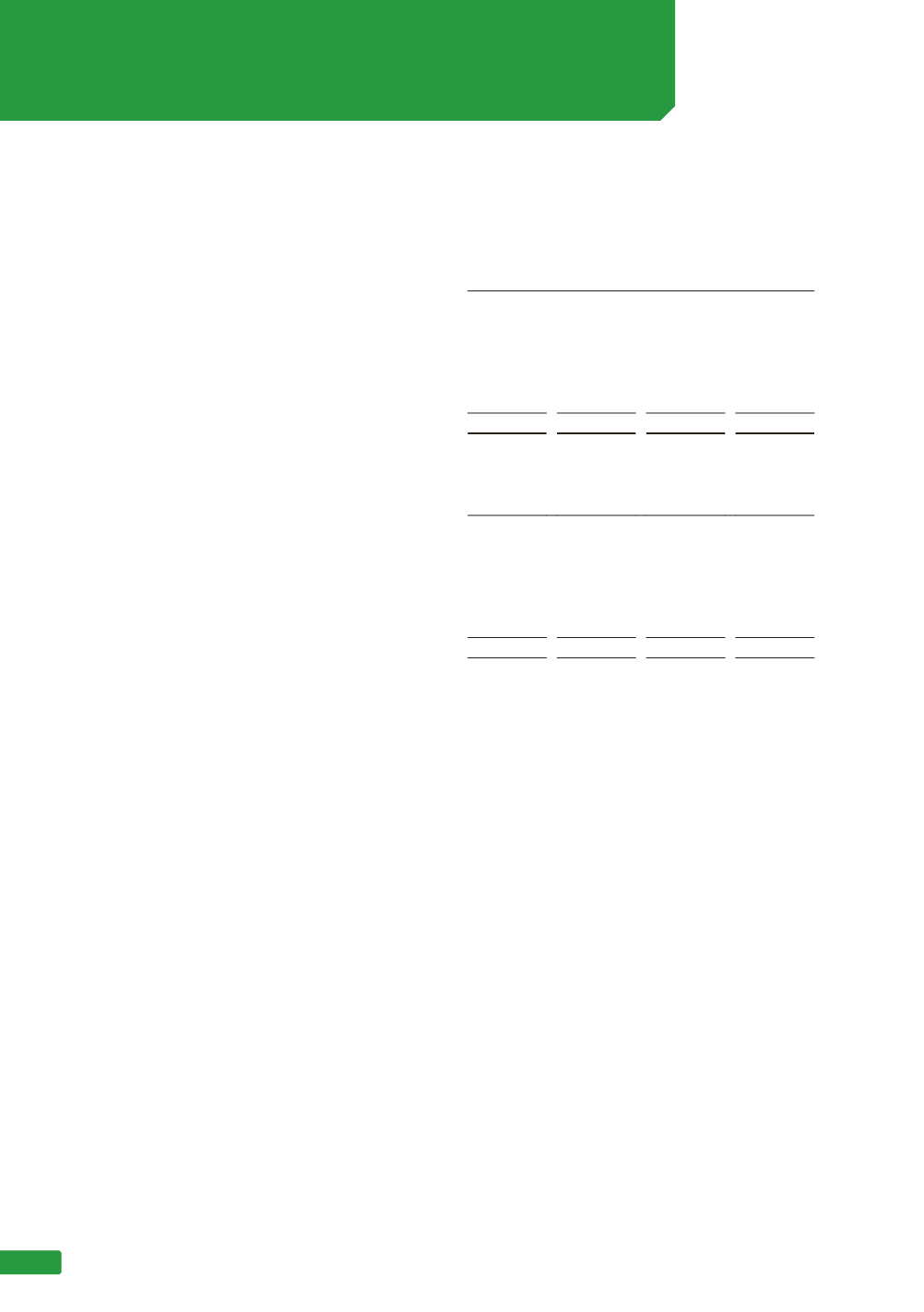

(iv) Sensitivity analysis - interest rate and foreign currency

Interest rate risk

-0.5%

+0.5%

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

30 June 2016

Financial assets

Cash and cash equivalents

(376)

(376)

376

376

Total increase/(decrease) in financial assets

(376)

(376)

376

376

Interest rate risk

-0.5%

+0.5%

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

30 June 2015

Financial assets

Cash and cash equivalents

(1,120)

(1,120)

1,120 1,120

Total increase/(decrease) in financial assets

(1,120)

(1,120)

1,120 1,120

This analysis assumes all other variables are constant.

NOTE 12 (CONTINUED)

FINANCIAL RISK MANAGEMENT

(a) Market risk (continued)

84