NOTE 6 (CONTINUED)

FINANCIAL ASSETS AND FINANCIAL LIABILITIES

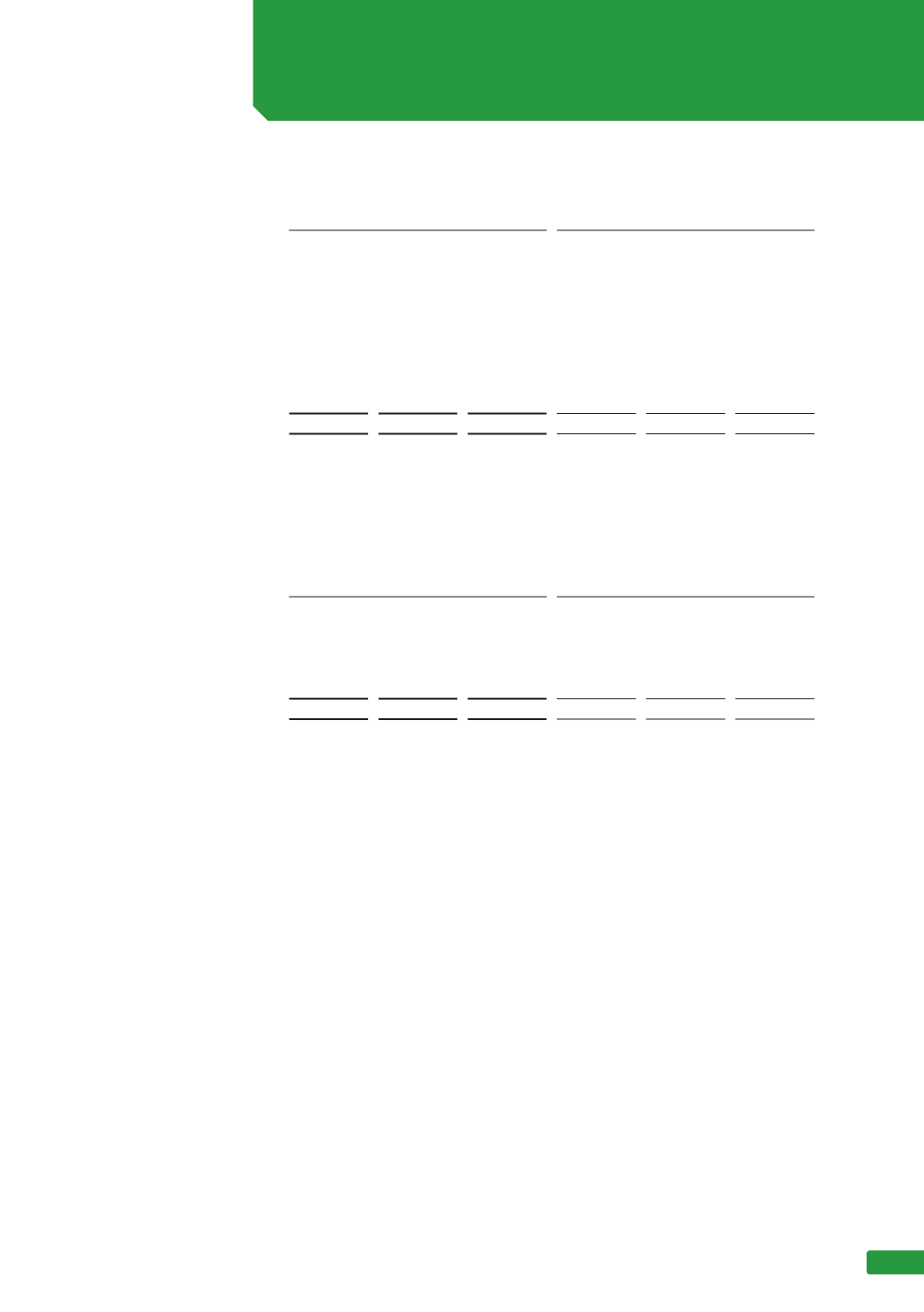

(d) Interest bearing liabilities

Consolidated

2016

2015

Current

$’000

Non-

current

$’000

Total

$’000

Current

$’000

Non-

current

$’000

Total

$’000

Bonds - maturing:

29 April 2016

-

-

-

251,398

- 251,398

20 December 2017

- 199,989 199,989

- 199,712 199,712

5 December 2019

- 174,972 174,972

- 174,840 174,840

11 December 2024

- 124,160 124,160

- 124,051 124,051

Syndicated debt facility

- 145,010 145,010

- 260,852 260,852

- 644,131 644,131

251,398 759,455 1,010,853

The cashflow movement of ($365.8m) (2015: $95.8) differs from the variance between the

balances above due to the impact of effective interest.

Consolidated

2016

2015

Current

$’000

Non-

current

$’000

Total

$’000

Current

$’000

Non-

current

$’000

Total

$’000

Other liabilities

73,757

516 74,273

1,559

-

1,559

73,757

516 74,273

1,559

-

1,559

Other liabilities is primarily comprised of a liability in respect of the over recovery of constrained

network coal revenue arising from the review by the ACCC of ARTC’s - Hunter Valley Access

Undertaking Compliance Submissions for 2013 onwards. The review has resulted in a reduction in

recognised revenue per the compliance submissions. It is expected that this revenue reduction will

be recovered over future years. This account was previously an asset and was classified under other

receivables. See note 4(viii) and 5(a).

(e) Other liabilities

63