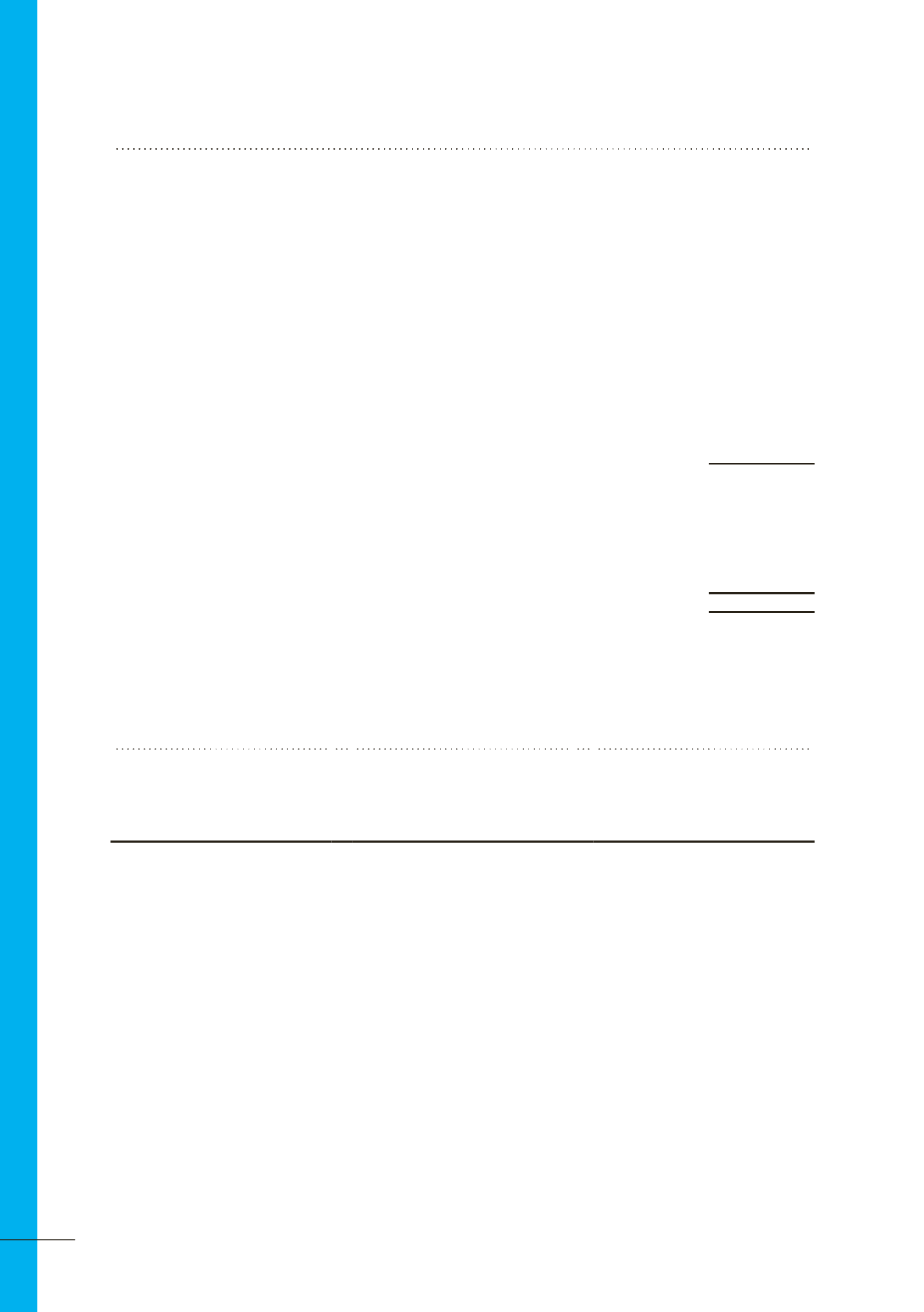

NOTE 12

FINANCIAL RISK MANAGEMENT (CONTINUED)

$’000

Opening balance 1 July 2012

3,098,048

Loss included in expenses

(481,990)

Additions

1,422,887

Depreciation

(152,873)

Disposals

(634)

Change in fair value included in other comprehensive income

160,797

Closing balance 30 June 2013

4,046,235

Loss included in expenses

2,060

Additions

274,136

Depreciation

(165,714)

Disposals

(364)

Change in fair value included in other comprehensive income

(29,099)

Closing balance 30 June 2014

4,127,254

(iii) Fair value measurements using significant unobservable inputs (level 3)

The following table presents the changes in level 3 items for the periods ended 30 June 2014 and 30 June 2013 for the

consolidated entity:

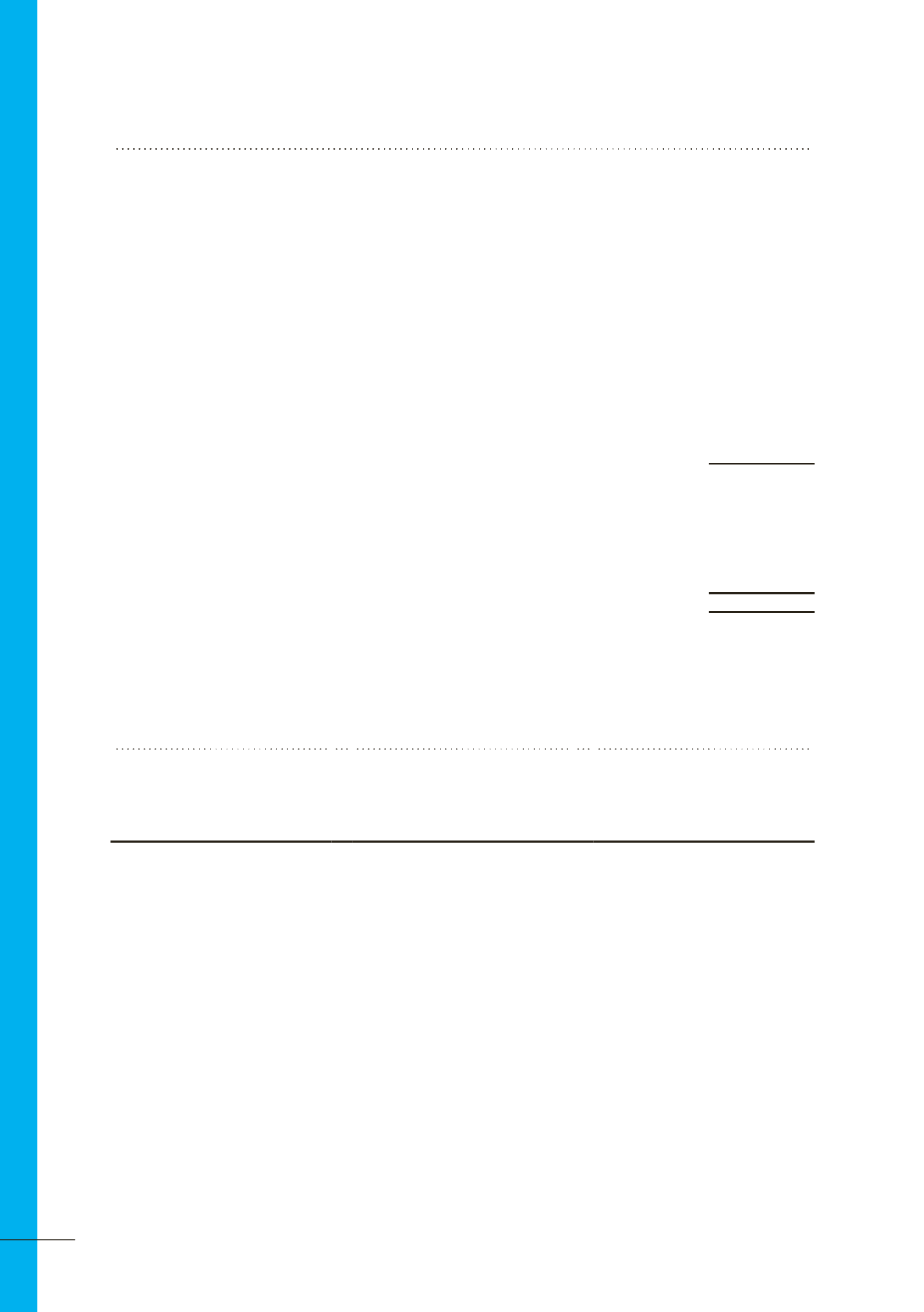

(iv) Valuation inputs and relationships to fair value

The following table summarises the information about the significant unobservable inputs used in level 3 fair value

infrastructure asset measurements. See (ii) above for the valuation techniques adopted.

Valuation technique

Significant unobservable inputs

Inter-relationship between

significant unobservable inputs

and fair value measurements

Discounted cash flows: The valuation

model considers the present value of

expected payment, discounted using

a risk-adjusted discount rate. The

expected payment is determined by

considering the cashflow forecasts

for each corridor. Risk adjustments

are made and terminal value

calculations are completed on a

probability basis.

• Forecast annual revenue,

• Maintenance and capital

expenditure,

• Risk-adjusted discount rate.

The estimated fair value would

increase (decrease) if; the annual

revenue growth rate were higher

(lower), if Maintenance and capital

expenditure were lower (higher); or

the risk adjusted discount rate were

lower (higher). Generally a change

in the annual revenue growth rate

is accompanied by a directionally

similar change in Maintenance and

capital expenditure.

(d) Fair value measurements (continued)

84