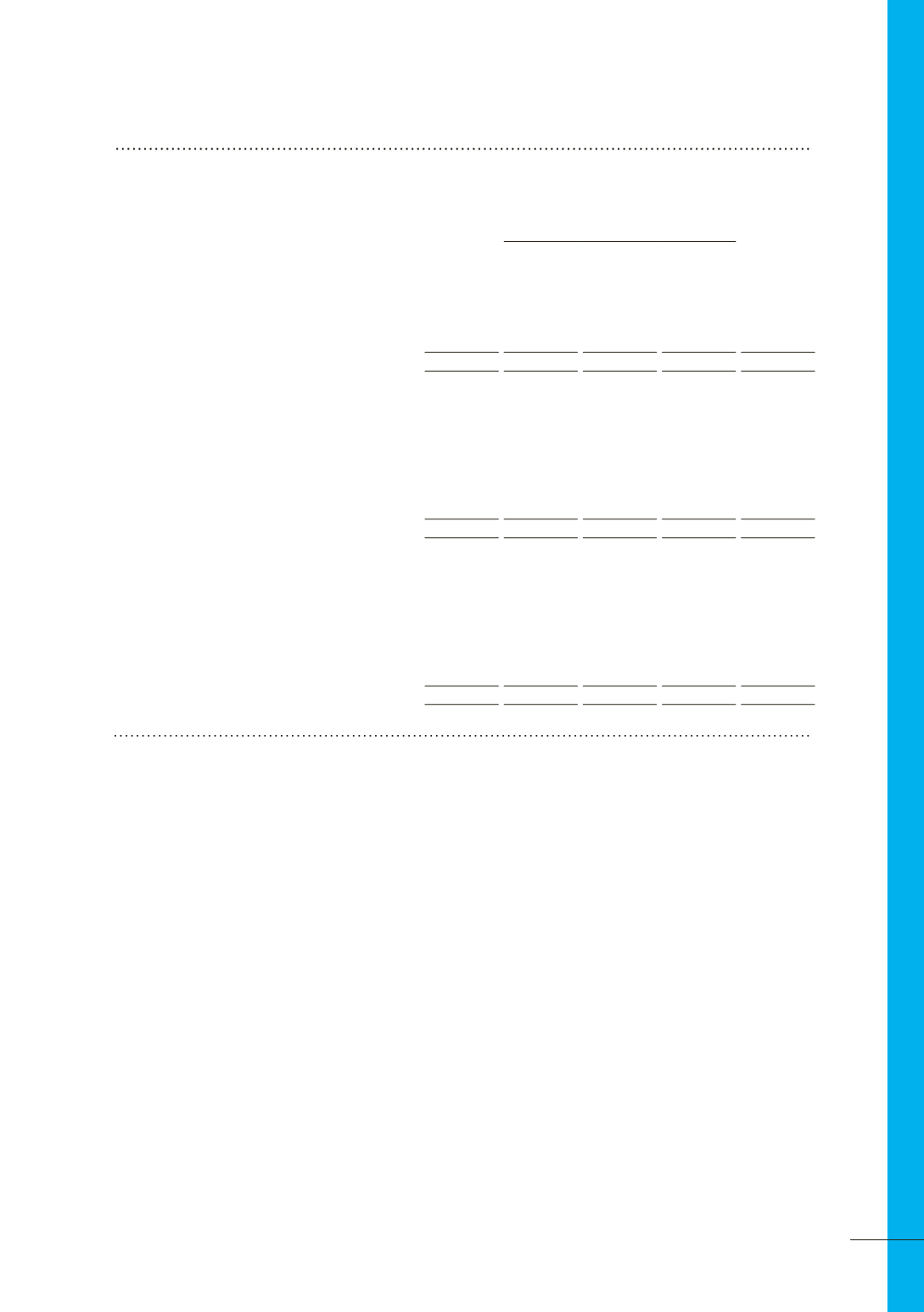

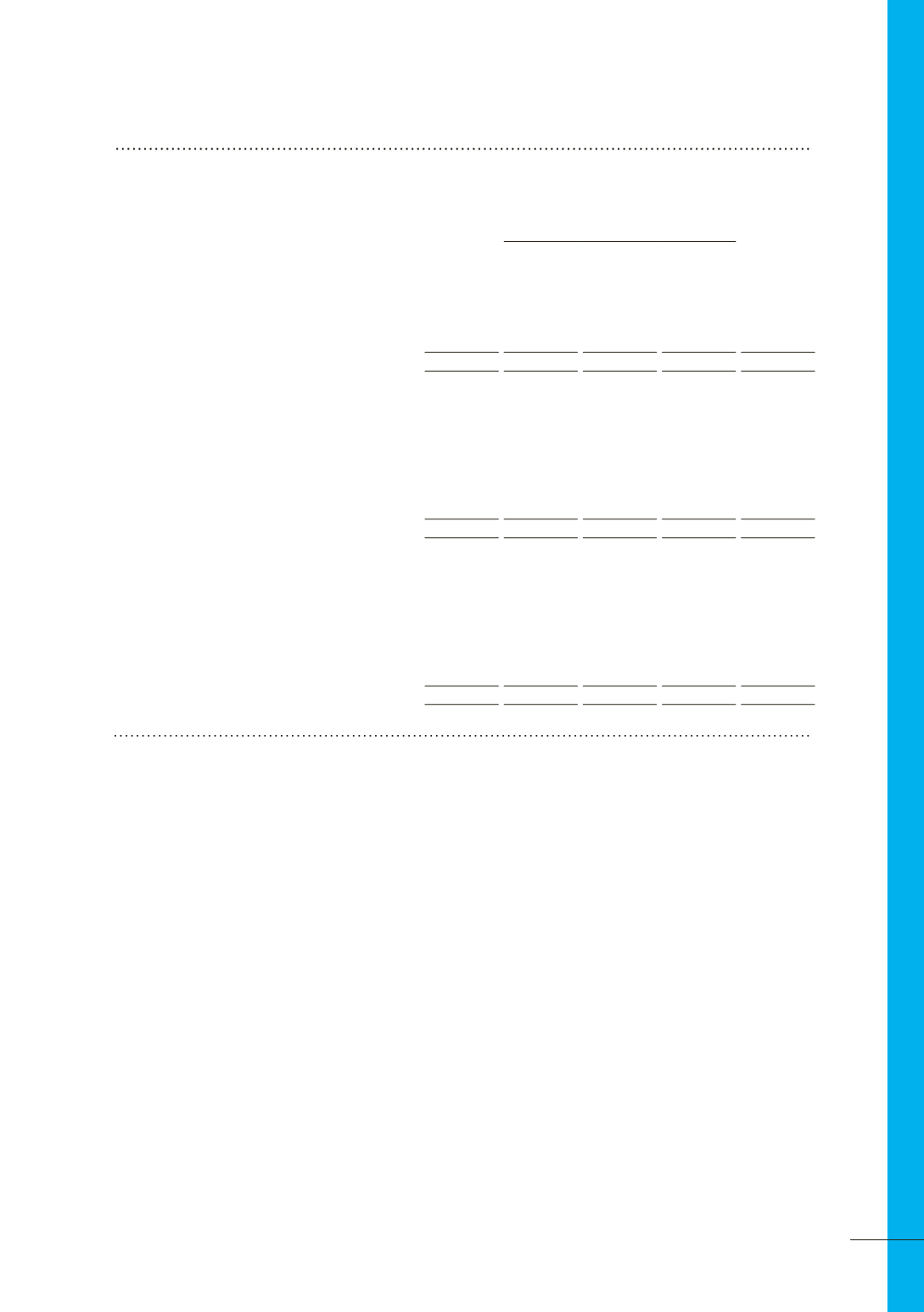

NOTE 12

FINANCIAL RISK MANAGEMENT (CONTINUED)

Fair Value

30 June 2013

Notes

Carrying

Value

$’000

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

Non financial assets

Designated at fair value

Infrastructure assets

8(c)

4,046,235

-

- 4,046,235 4,046,235

Total non financial assets

4,046,235

-

- 4,046,235 4,046,235

Financial assets

Fair value hedging instruments

Foreign exchange forward

contracts used for hedging

12(a)

100

-

100

-

100

Loans and receivables

Trade and other receivables

6(b)

95,701

-

-

-

95,701

Cash and cash equivalents

6(a)

217,375

-

-

-

217,375

Total financial assets

313,176

-

100

-

313,176

Financial liabilities

Fair value - hedging instruments

Interest rate swaps used for hedging 12(a)

7,981

-

7,981

-

7,981

Other financial liabilities

Interest bearing liabilities

6(d)

1,080,140

-

-

- 1,080,140

Trade payables

6(c)

94,132

-

-

-

94,132

Finance lease liabilities

6(e)

400

-

-

-

400

Total financial liabilities

1,182,653

-

7,981

- 1,182,653

Level 1:

The fair value of instruments traded in active

markets (such as publicly traded derivatives, and

trading and available-for-sale securities) is based

on quoted market prices at the end of the reporting

period. These instruments are included in level 1.

Level 2:

The fair value of instruments that are not trad-

ed in an active market (for example, over-the-counter

derivatives) is determined using valuation techniques

which maximise the use of observable market data and

rely as little as possible on entity specific estimates. If

all significant inputs required to fair value an instrument

are observable, the instrument is included in level 2.

Level 3:

If one or more of the significant inputs is not

based on observable market data, the instrument is

included in level 3.

Disclosed fair values

The carrying amounts of trade receivables and payables,

bonds, banking facilities, cash and short term deposits

equates approximately to their fair values due to their

nature and are carried at amortised cost.

There were no transfers between levels 1, 2 and 3 for

recurring fair value measurements during the current

or the previous financial year. The Group’s policy is to

recognise transfers into and transfers out of fair value

hierarchy levels as at the end of the reporting period.

(ii) Valuation techniques used to determine

fair values

Specific valuation techniques used to value financial

instruments include:

•

•

The fair value of interest rate swaps is calculated

as the present value of the estimated future

cash flows based on observable yield curves. The

present values and discounted rates used were

adjusted for counterparty and own credit risk and

is not considered a significant input.

•

•

The fair value of forward foreign exchange

contracts is determined using forward exchange

rates at the balance sheet date.

•

•

The fair value of infrastructure assets is determined

using discounted cash flow projections based on

reliable estimates of future cash flows.

(d) Fair value measurements (continued)

83