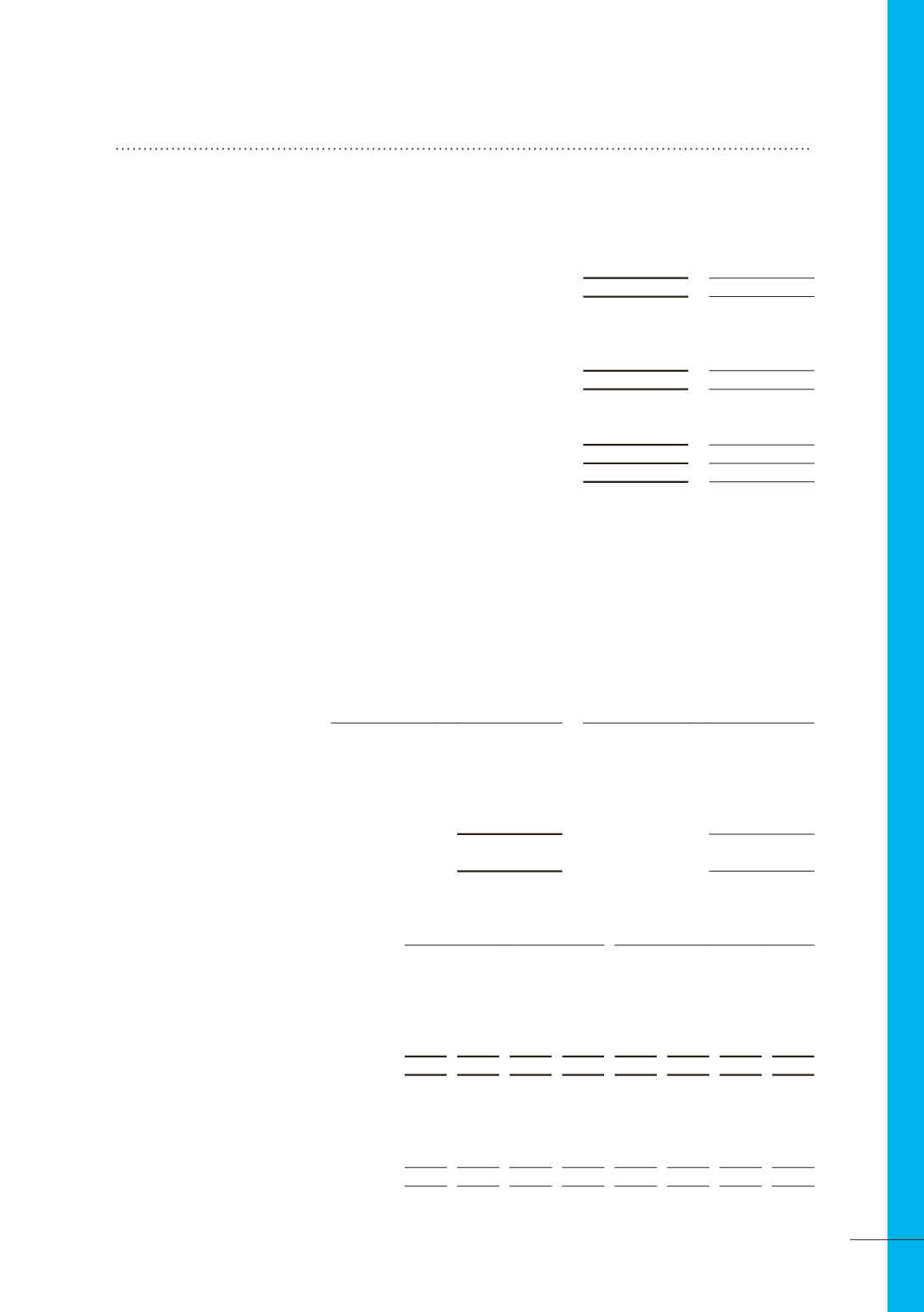

NOTE 12

FINANCIAL RISK MANAGEMENT (CONTINUED)

Consolidated

2014

$’000

2013

$’000

Current assets

Forward foreign exchange contracts - cash flow hedges

-

100

Total current derivative financial instrument assets

-

100

Current liabilities

Interest rate swap contracts - cash flow hedges

(2,001)

-

Forward foreign exchange contracts - cash flow hedges

(31)

-

Total current derivative financial instrument liabilities

(2,032)

-

Non-current liabilities

Interest rate swaps - cash flow hedges

(1,086)

(7,981)

Total non-current derivative financial instrument liabilities

(1,086)

(7,981)

Total derivative financial instrument liabilities

(3,118)

(7,981)

(iii) Classification of derivatives

Derivatives are classified as hedging instruments and accounted for at fair value in other comprehensive income and

deferred in equity in the hedging reserve. It is reclassified into the income statement when the hedged interest expense

is recognised.

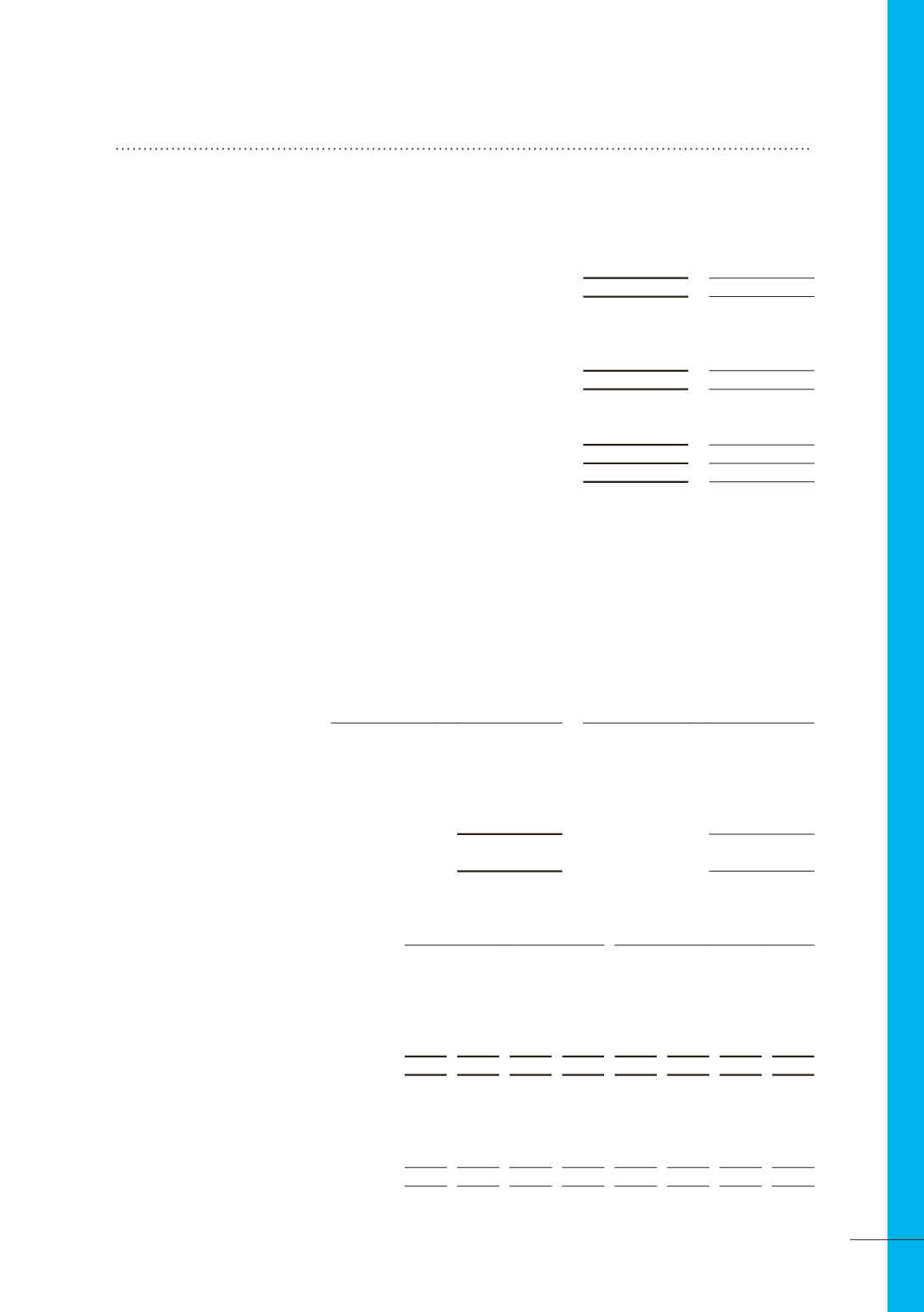

(iv) Derivative financial instruments

Consolidated

30 June 2014

30 June 2013

Weighted

average

interest rate

Balance

Weighted

average

interest rate

Balance

$’000

$’000

Cash and cash equivalents

3.2%

91,284

3.2%

217,375

Net exposure to cash flow

interest rate risk

91,284

217,375

Interest rate risk

Foreign exchange risk

-0.5% +0.5% -10% +10%

At 30 June 2014

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

Profit

$’000

Equity

$’000

Financial assets

Cash and cash equivalents

(315)

(315)

315 315

-

-

-

-

Derivatives cash flow hedge - foreign exchange

-

-

-

-

-

(31)

-

65

Total increase/(decrease) in financial assets

(315) (315)

315 315

-

(31)

-

65

30 June 2013

Financial assets

Cash and cash equivalents

(760)

(760)

760 760

-

-

-

-

Derivatives cash flow hedge - foreign exchange

-

-

-

-

-

(66)

-

54

Total increase/(decrease) in financial assets

(760)

(760)

760 760

-

(66)

-

54

This analysis assumes all other variables are constant.

(a) Market risk (continued)

79