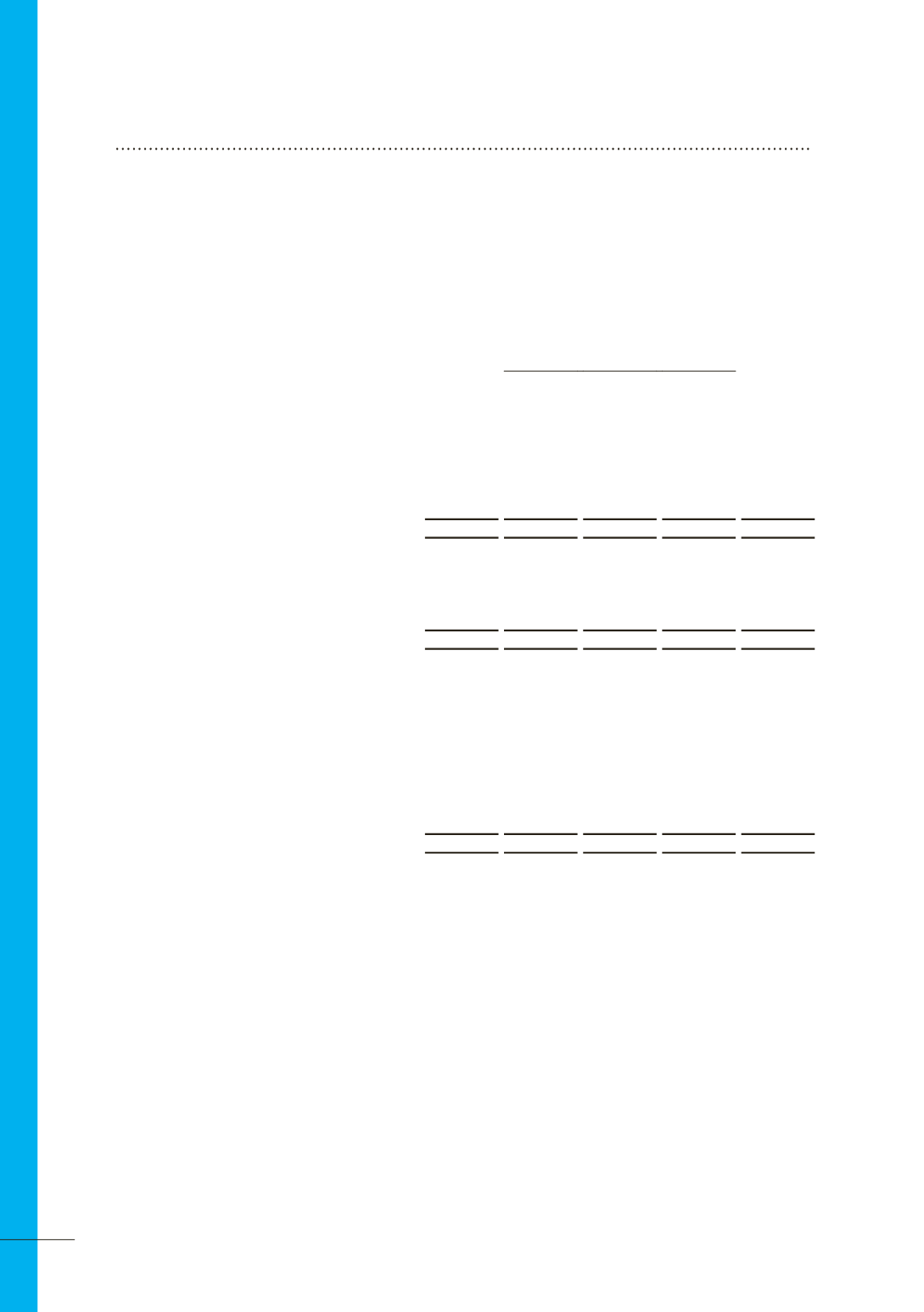

NOTE 12

FINANCIAL RISK MANAGEMENT (CONTINUED)

(d) Fair value measurements

(i)

Fair value hierarchy and accounting classification

Judgements and estimates are made in determining the fair values of the items that are recognised and measured at

fair value in the financial statements. The reliability of the inputs used in determining fair value, has been classified into

the three levels prescribed under AASB 13. An explanation of each level follows underneath the table.

Fair Value

30 June 2014

Notes

Carrying

Value

$’000

Level 1

$’000

Level 2

$’000

Level 3

$’000

Total

$’000

Non financial assets

Designated at fair value

Infrastructure assets

8(c)

4,127,254

-

- 4,127,254 4,127,254

Available for sale

Properties held for sale

8(b)

1,968

1,968

-

-

1,968

Total non financial assets

4,129,222

1,968

- 4,127,254 4,129,222

Financial assets

Loans and receivables

Trade and other receivables

6(b)

79,934

-

-

-

79,934

Cash and cash equivalents

6(a)

91,284

-

-

-

91,284

Total financial assets

171,218

-

-

-

171,218

Financial liabilities

Fair value - hedging instruments

Interest rate swaps used for hedging 12(a)

3,087

-

3,087

-

3,087

Foreign exchange forward

contracts used for hedging

12(a)

31

-

31

-

31

Other financial liabilities

Interest bearing liabilities

6(d)

916,327

-

-

-

916,327

Trade payables

6(c)

82,119

-

-

-

82,119

Finance lease liabilities

6(e)

84

-

-

-

84

Total financial liabilities

1,001,648

-

3,118

- 1,001,648

82