NOTE 12

FINANCIAL RISK MANAGEMENT (CONTINUED)

(c) Liquidity risk

Prudent liquidity risk management implies maintaining

sufficient cash and cash equivalents, the availability

of committed credit facilities to support funding

requirements and the ability to close out market

positions. The Group manages liquidity risk by

continuously monitoring forecast and actual cash

flows and maintaining adequate liquidity reserves

to support forecast net business expenditure

requirements for a minimum of 12 months on a rolling

monthly basis.

Financing arrangements of the Group include a $500m

four year syndicated debt facility, established 26

June 2014 and a 15 month bridging facility of $300m

established on 24 June 2014. As at 30 June 2014

$165m of the syndicated debt facility has been utilised

(2013: $329m).

The Group has a $750mAustralian Dollar Domestic Note

programme which is fully issued, of this $300mmatures

in the next financial year (note 6(d)). The Group also has

access to business card facilities of $2m (2013: $2m).

As at the reporting date of 30 June 2014, as the bond

issuer ARTC complied with clause 4.3 Earnings and

Asset Covenant of the Information Memorandum.

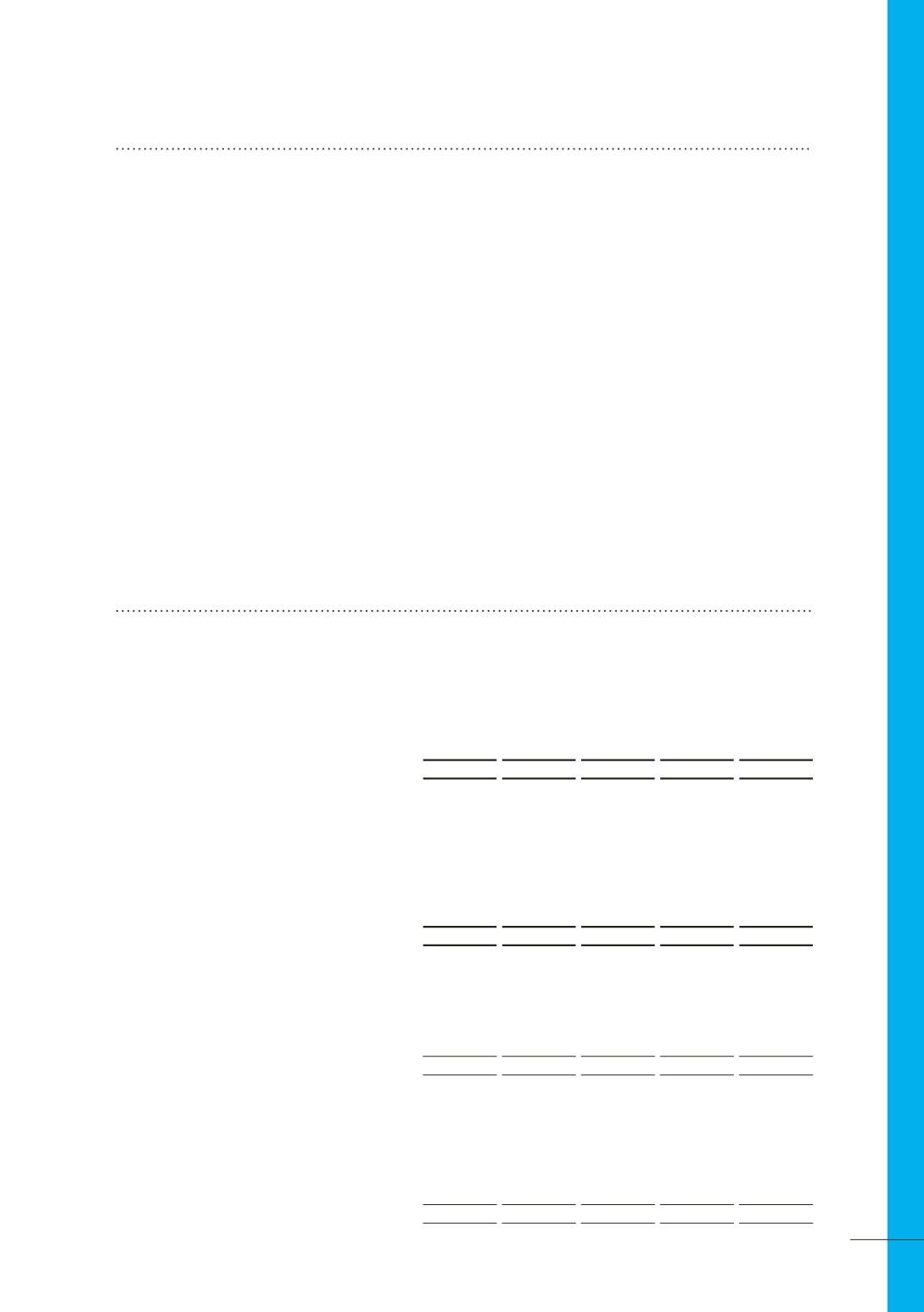

Maturities of financial assets and liabilities based

on contractual maturities

The tables below analyse the Group’s financial assets

and liabilities into relevant maturity groupings based

on the remaining period at the reporting date to the

contractual maturity date.

The amounts disclosed in the table are the contractual

principal and accrued interest undiscounted cash flows.

Less than 6

months

6 - 12

months

Between 1

and 5 years

Over 5

years

Total cash-

flows

At 30 June 2014

$’000

$’000

$’000

$’000

$’000

Financial assets

Cash & cash equivalents

91,284

-

-

-

91,284

Trade & other receivables

79,934

-

-

-

79,934

Total financial assets

171,218

-

-

-

171,218

Financial liabilities

Trade & other payables

82,119

-

-

-

82,119

Bond issue

300,710

-

450,544

-

751,254

Borrowings

-

-

165,073

-

165,073

Derivatives financial liabilities - foreign exchange

31

-

-

-

31

Derivatives financial liabilities - interest rate swap

2,001

-

1,086

-

3,087

Other financial liabilities

84

-

-

-

84

Total financial liabilities

384,945

-

616,703

- 1,001,648

At 30 June 2013

Financial assets

Cash & cash equivalents

217,375

-

-

-

217,375

Trade & other receivables

95,701

-

-

-

95,701

Derivatives financial instruments - foreign exchange

100

-

-

-

100

Total financial assets

313,176

-

-

-

313,176

Financial liabilities

Trade & other payables

94,132

-

-

-

94,132

Bond issue

-

-

750,231

-

750,231

Borrowings

329,909

-

-

-

329,909

Derivatives financial liabilities - interest rate swap

-

-

7,981

-

7,981

Other financial liabilities

158

158

84

-

400

Total financial liabilities

424,199

158 758,296

- 1,182,653

81