Accounting Policy

Depreciation and amortisation

Accounting policies for depreciation and amortisation refer to note 7(c).

Accounting Policy

Recoveries and expenses associated with rail access related incidents

Income attributable to insurance or other recoveries arising from rail access related incidents is only

recognised where a contractual agreement is in place and receipt of amounts outstanding is virtually

certain. Costs of rectification are recognised when incurred.

Where the Group has suffered damage to its rail network due to other parties, the recourse is

commercial negotiation and, if not successful, legal proceedings are initiated, as appropriate.

Potential liabilities and assets are reviewed throughout the year and finalised at reporting date for

inclusion in the financial statements. Inclusion of liabilities or assets relating to rail access related

incidents occurs where the Group can reliably measure costs or recoveries.

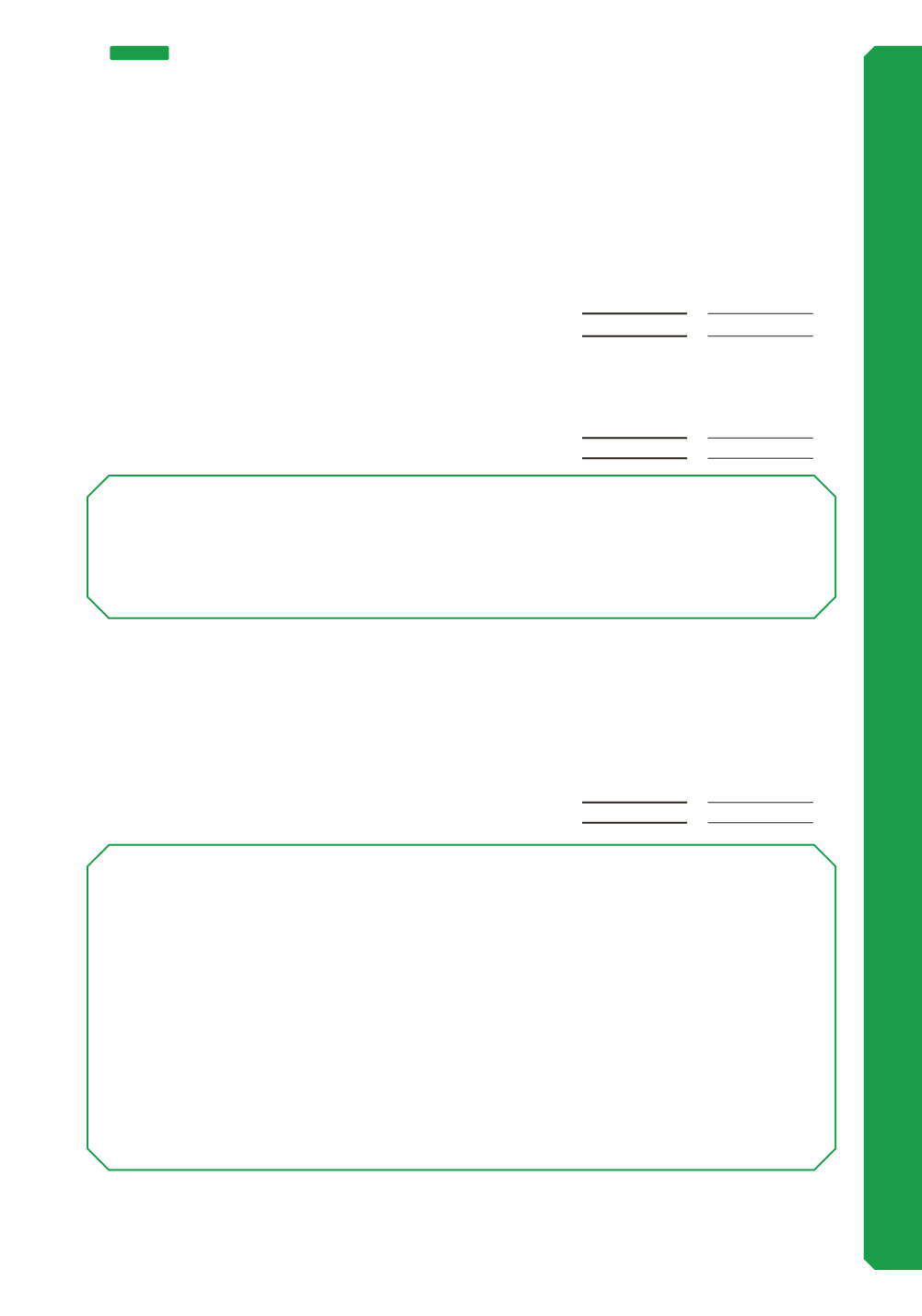

Consolidated

2017

$’000

2016

$’000

Depreciation

Buildings

1,044

1,013

Plant and equipment

180,066

183,525

181,110

184,538

Amortisation

Computer software

2,754

2,355

Land rights

946

825

Other

3,772

3,772

7,472

6,952

Consolidated

2017

$’000

2016

$’000

Expenses - Incident cost

18,891

7,109

Other income - Incident and insurance recovery

4,909

2,508

13,982

4,601

(d) Depreciation and amortisation

(e) Net incident cost

77

NOTE 5

INCOME AND EXPENSES (CONTINUED)