Consolidated

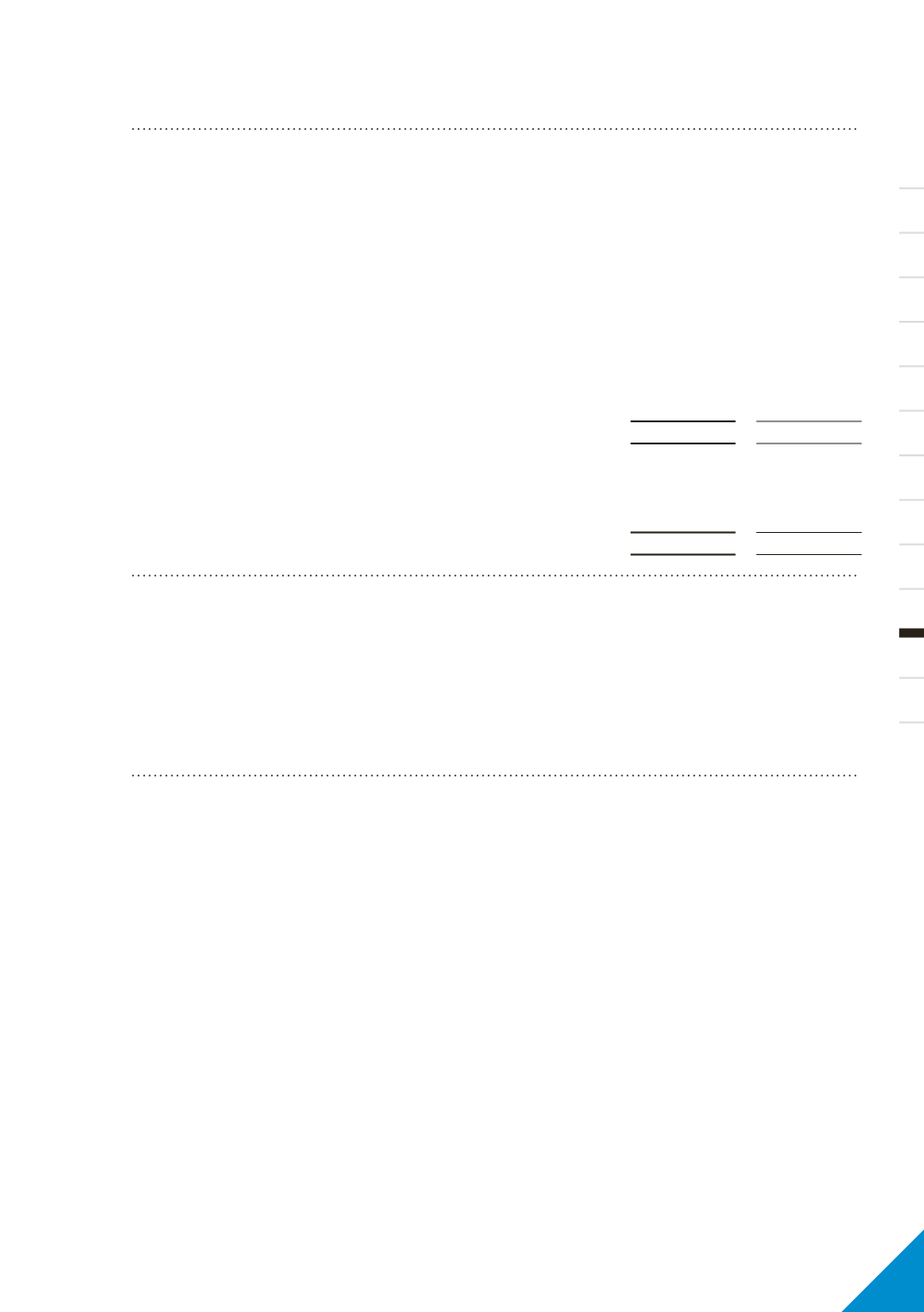

(c) Amounts charged or credited directly to equity

2012

2011

$’000

$’000

Deferred income tax related to items charged directly to equity

(refer to note 31(a))

Net gain on revaluation of infrastructure assets

-

153,793

Net loss on reversal of revaluation of infrastructure assets

(refer note 17 and 27)

(94,758)

-

Net (loss)/gain on defined benefit fund

(1,512)

7

Net (loss)/gain on interest rate swap

(1,633)

-

Net gain/(loss) ‑ foreign exchange hedge

45

(7)

Total

(97,858)

153,793

Deferred income tax charge included in equity comprises:

Increase/(decrease) in deferred liabilities

52

153,793

(Increase)/decrease in deferred assets

(97,910)

-

Total

(97,858)

153,793

Note 06

Income tax expense/ (benefit) (continued)

(d) Tax assets

At 30 June 2012, the Group has unrecognised

deferred tax assets in relation to temporary

differences of $307.4m (2011: $197.2m)

associated with the Group’s ability to claim tax

depreciation on NSW lease assets as a result of

the Group being able to use Division 58 of the

Income Tax Assessment Act 1997 and also due

to the impairment of the North‑South assets.

(e) Tax consolidation legislation

Australian Rail Track Corporation Ltd and its

wholly‑owned Australian controlled entities have

implemented the tax consolidation legislation as

of 1 July 2003. The accounting policy in relation to

this legislation is set out in note 1(h).

The Australian Taxation Office is

currently undertaking a specific review

of ARTC’s 2009/10 income tax claim

as a part of the Australian Taxation

Office’s large business review program.

The review is expected to be finalised in

September 2012.

81