Note 02

Financial risk management (continued)

The Group had access to the following overdraft facilities at the reporting date:

Consolidated

2012

2011

$’000

$’000

Floating rate

‑ Expiring within one year

(bank overdraft, business card and revolving lease facility)

20,000

20,000

The bank overdraft facilities may be drawn at any

time and the extension of such facilities beyond

the expiry date is at the discretion of the bank.

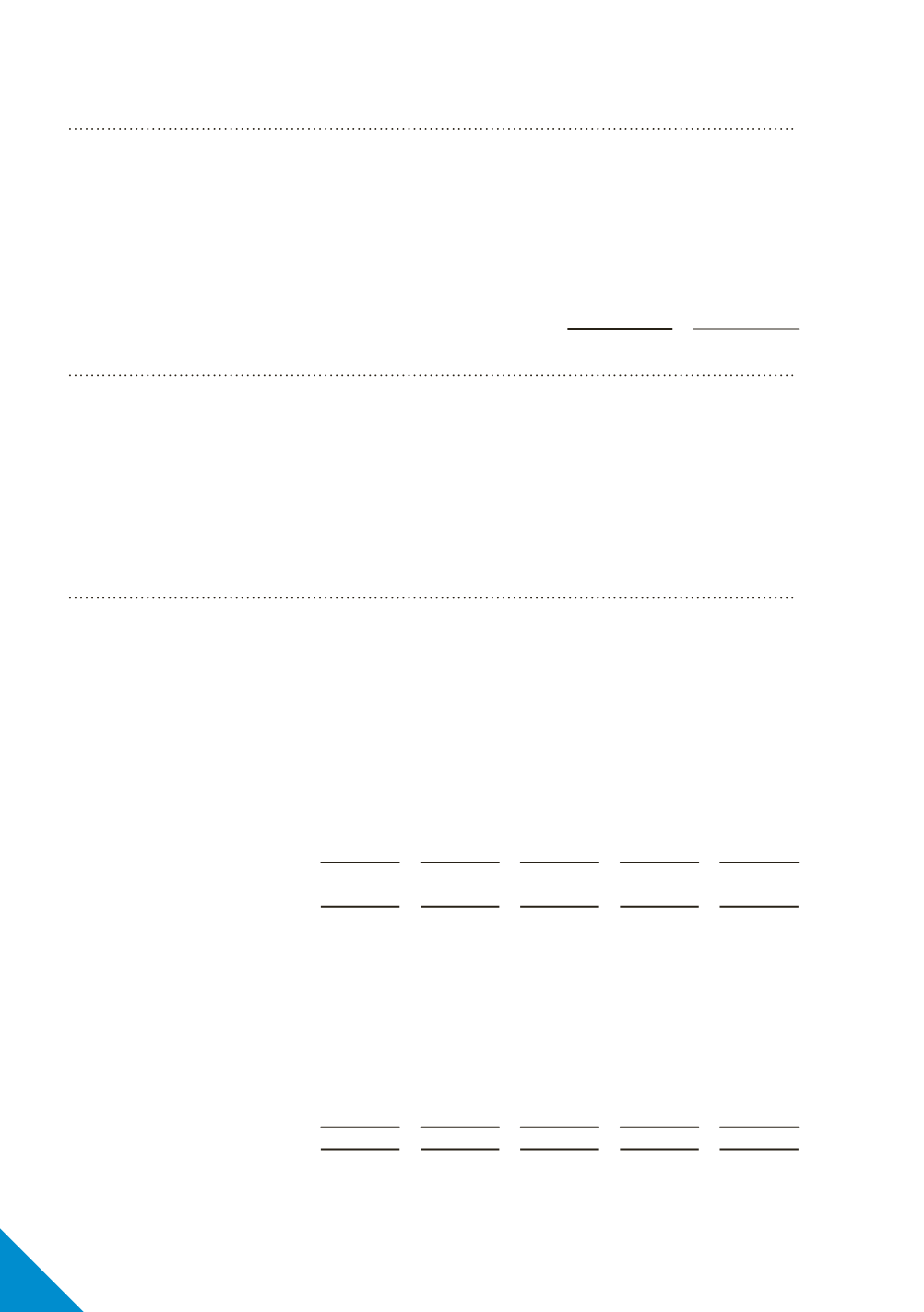

Maturities of financial assets based on

contractual maturities

The tables below analyse the Group’s financial

assets and liabilities into relevant maturity

groupings based on the remaining period at

the reporting date to the contractual maturity

date. The amounts disclosed in the table are the

contractual undiscounted cash flows.

Contractual maturities of

financial liabilities

Less

than 6

months

6 ‑ 12

months

Between

1 and 5

years

Over 5

years

Total

At 30 June 2012

$’000

$’000

$’000

$’000

$’000

Financial assets

Cash & cash equivalents

45,924

-

-

-

45,924

Trade & other receivables

102,870

-

-

-

102,870

Derivatives financial instruments

‑ foreign exchange

7

168

-

-

175

Total financial assets

148,801

168

-

-

148,969

Financial liabilities

Trade & other payables

157,893

-

-

-

157,893

Bond Issue

-

-

299,936

198,991

498,927

Borrowings

20,002

-

-

-

20,002

Derivatives financial instruments

‑ foreign exchange

33

-

-

-

33

Derivatives financial instruments

‑ interest rate swap

-

-

5,446

-

5,446

Other financial liabilities

116

117

392

-

625

Total financial liabilities

178,044

117 305,774 198,991 682,926

74