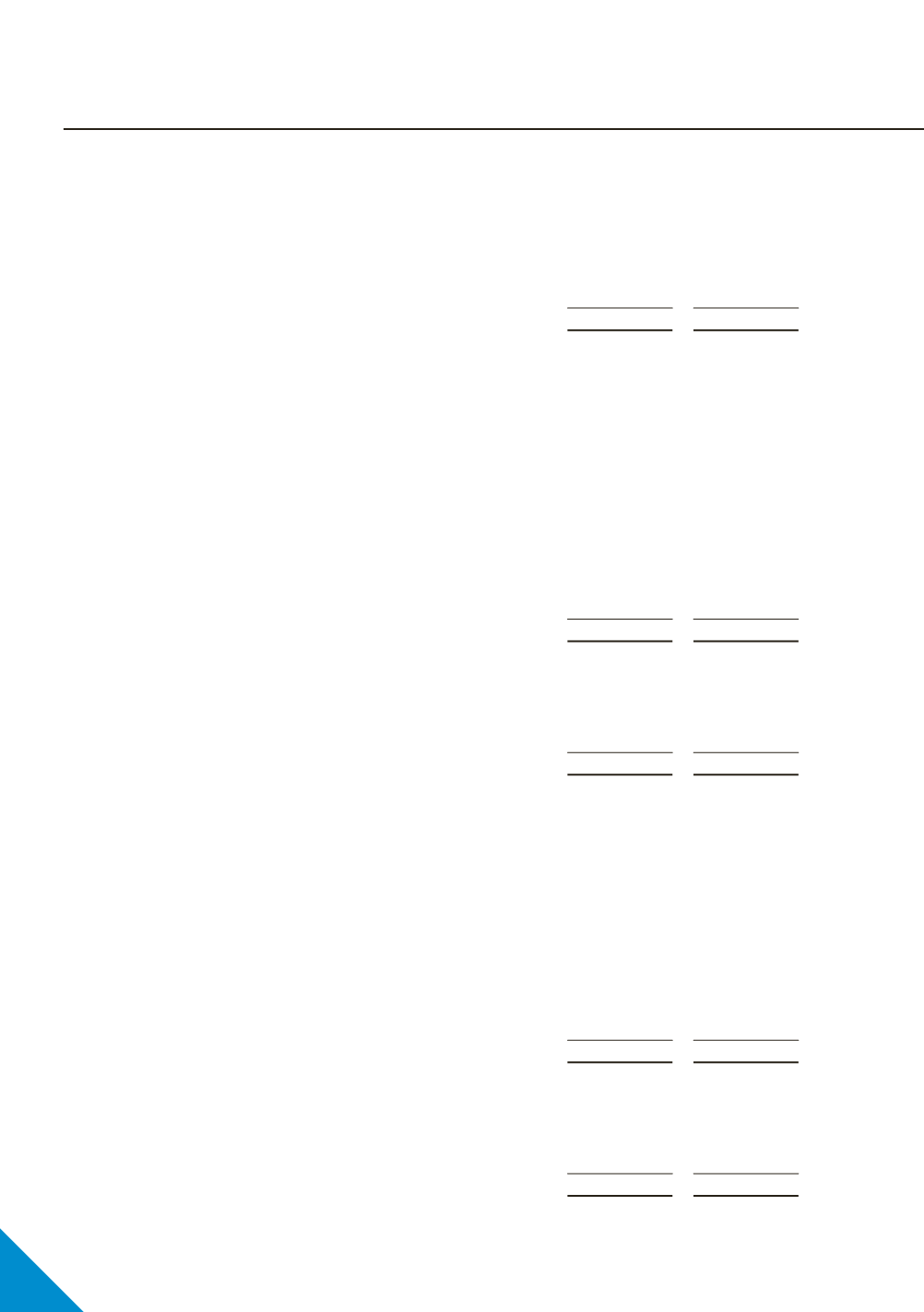

Note 16

Non-current assets - Property, plant and equipment

Construction

in progress Freehold land

Notes

$’000

$’000

At 1 July 2010

Cost or fair value

827,809

5,841

Valuation

-

-

Accumulated depreciation

-

-

Net book amount

827,809

5,841

Year ended 30 June 2011

Opening net book amount as at 30 June 2010

827,809

5,841

Reclassify asset from freehold land to intangible assets

-

(5,810)

Additions into asset register from capital work in progress

-

69

Borrowing cost capitalised

1,335

-

Additions into capital work in progress

880,179

-

Impairment charge recognised in Consolidated

Income Statement

(434,235)

-

Depreciation charge

-

-

Transfers out of capital work in progress

(430,858)

-

Written down value of assets disposed

-

-

Revaluation of assets

-

-

Closing net book amount

844,230

100

At 30 June 2011

Cost or fair value

844,230

100

Valuation

-

-

Accumulated depreciation

-

-

Net book amount

844,230

100

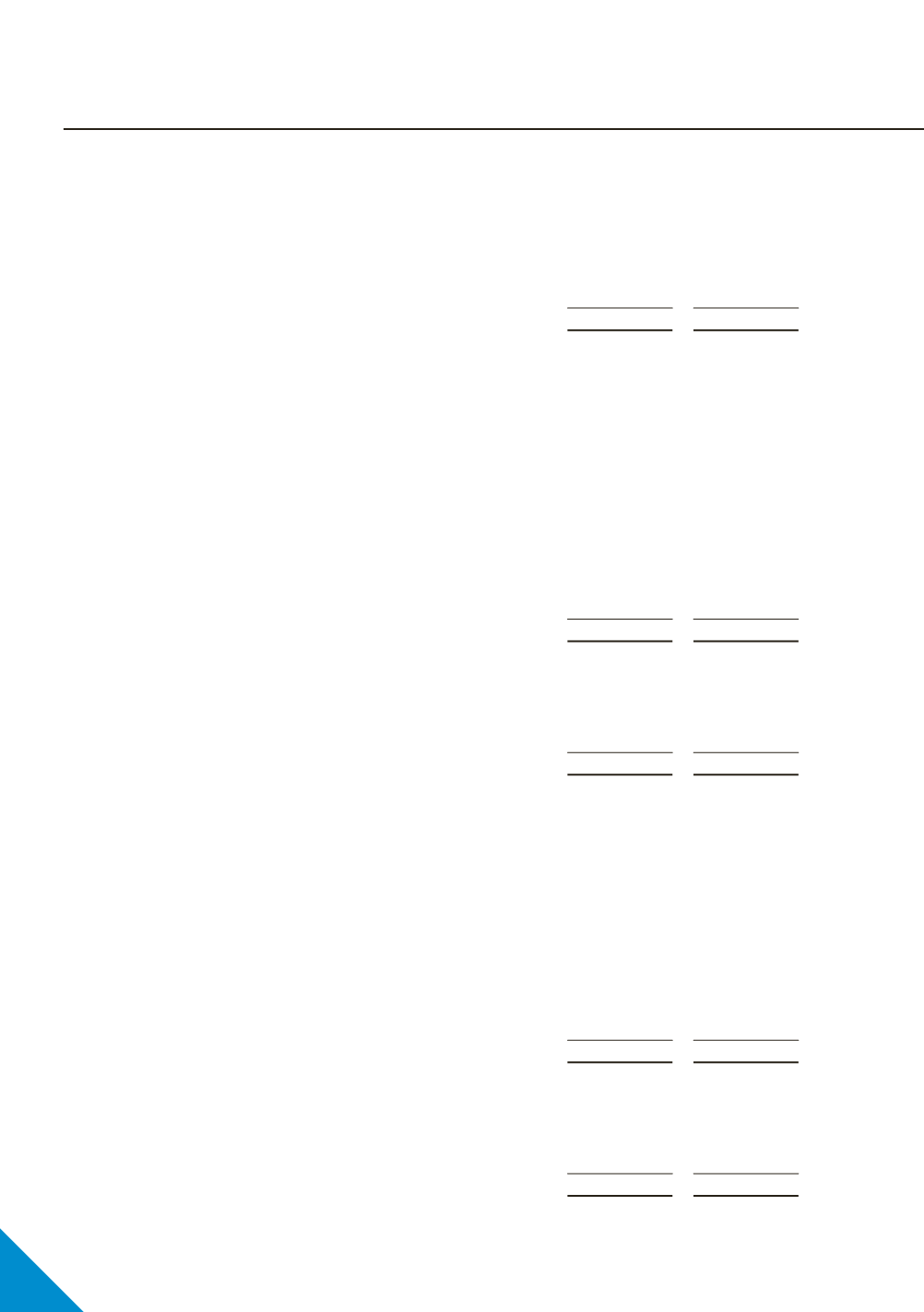

Year ended 30 June 2012

Opening net book amount as at 30 June 2011

844,230

100

Additions into asset register from capital work in progress

-

16

Borrowing cost capitalised

9,926

-

Additions into capital work in progress

1,158,035

-

Impairment charge recognised in Consolidated

Income Statement

(290,206)

-

Depreciation charge

-

-

Transfers out of capital work in progress

(681,221)

-

Written down value of assets disposed

-

-

Revaluation reversal of assets

-

-

Closing net book amount

1,040,764

116

At 30 June 2012

Cost or fair value

1,040,764

116

Valuation

(b)

-

-

Accumulated depreciation

-

-

Net book amount

1,040,764

116

88