Note 02

Financial risk management (continued)

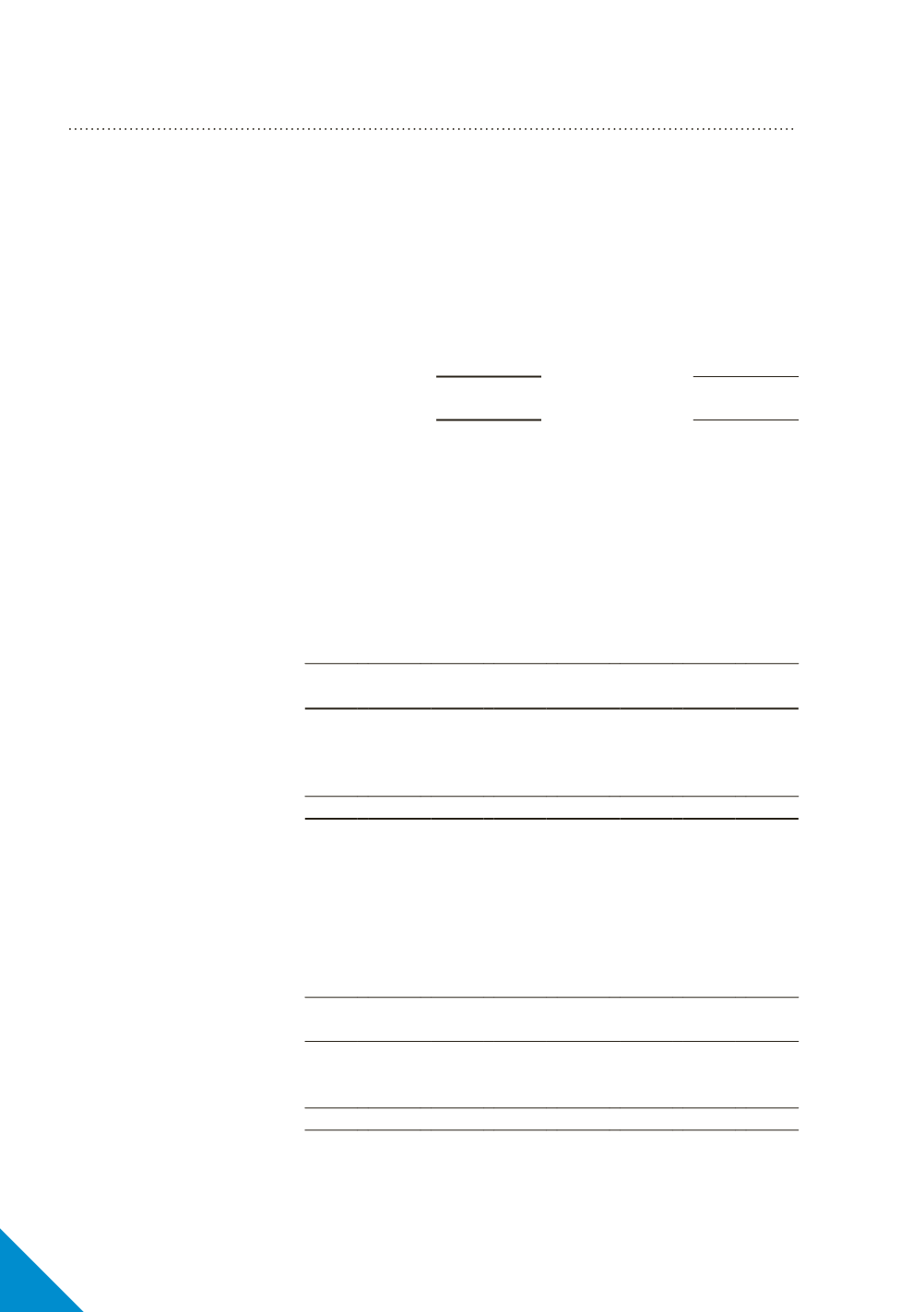

As at the reporting date, the Group had the following variable rate investments :

30 June 2012

30 June 2011

Consolidated

Weighted

average

interest rate

Balance

Weighted

average

interest rate

Balance

%

$’000

%

$’000

Cash at bank

4.1%

45,924

4.4%

33,513

Deposits at call

-%

-

5.8%

90,114

Held to maturity assets

-%

-

6.1%

20,418

Net exposure to cash flow

interest rate risk

45,924

144,045

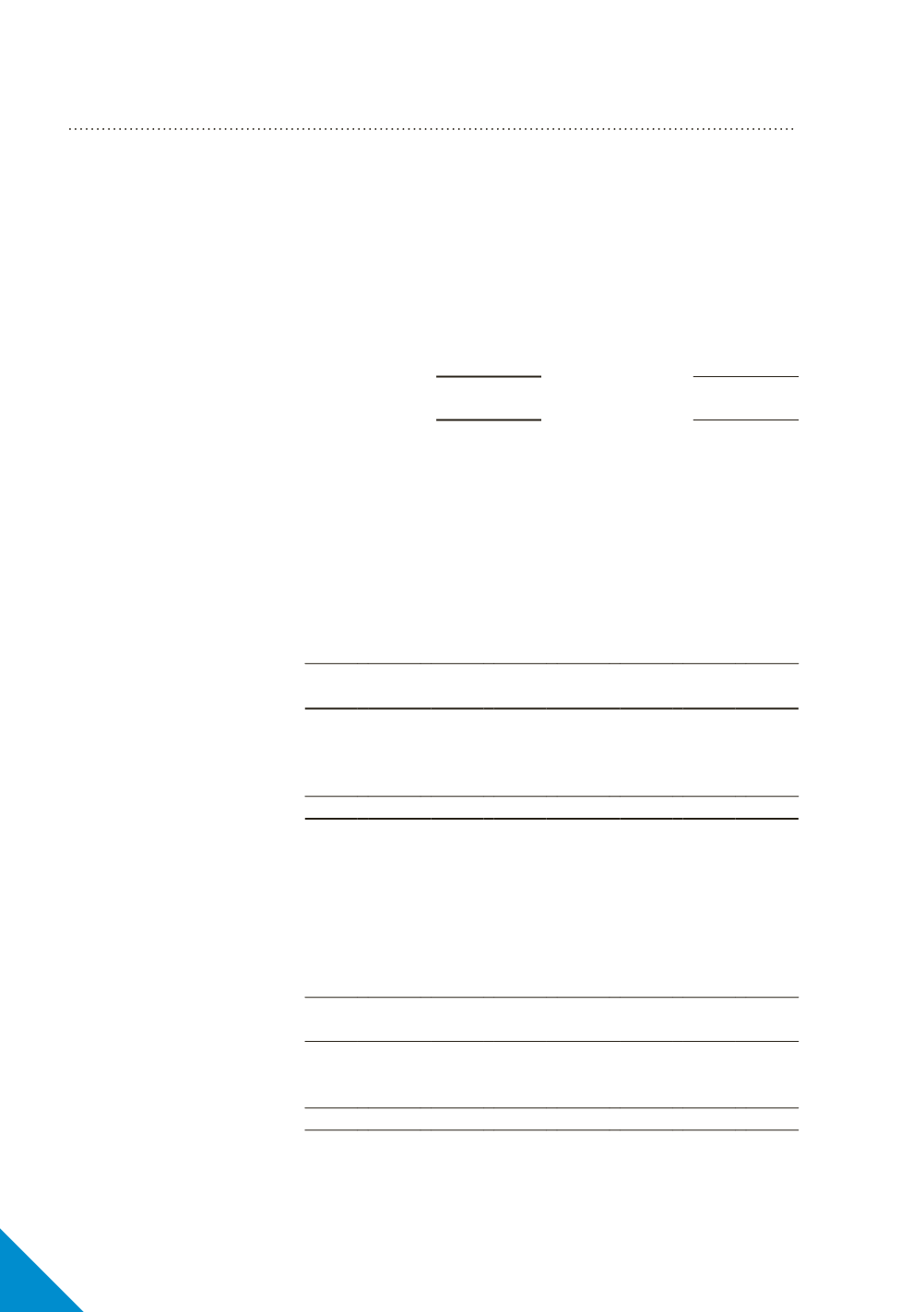

Consolidated

Interest rate risk

Foreign exchange risk

30 June 2012

‑0.5% +0.5% ‑10%

+10%

Profit Equity Profit Equity Profit Equity Profit Equity

$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000

Financial assets

Cash and cash equivalents

(161)

(161)

161 161

-

-

-

-

Derivatives cash flow hedge –

foreign exchange

-

-

-

-

-

(547)

-

458

Total increase/

(decrease) in financial assets

(161) (161)

161 161

- (547)

-

458

Financial liabilities

Derivatives cash flow hedge –

foreign exchange

-

-

-

-

-

(44)

-

36

Net increase/(decrease)

(161) (161)

161 161

- (591)

-

494

Consolidated

Interest rate risk

Foreign exchange risk

30 June 2011

‑0.5%

+0.5%

‑10%

+10%

Profit Equity Profit Equity Profit Equity Profit Equity

$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000

Financial assets

Cash and cash equivalents

(117)

(117)

117 117

-

-

-

-

Total increase/(decrease) in

financial assets

(117)

(117)

117 117

-

-

-

-

Financial liabilities

Derivatives ‑ cash flow hedges

-

-

-

-

-

46

-

(37)

Net increase/(decrease)

(117)

(117)

117 117

-

46

-

(37)

72