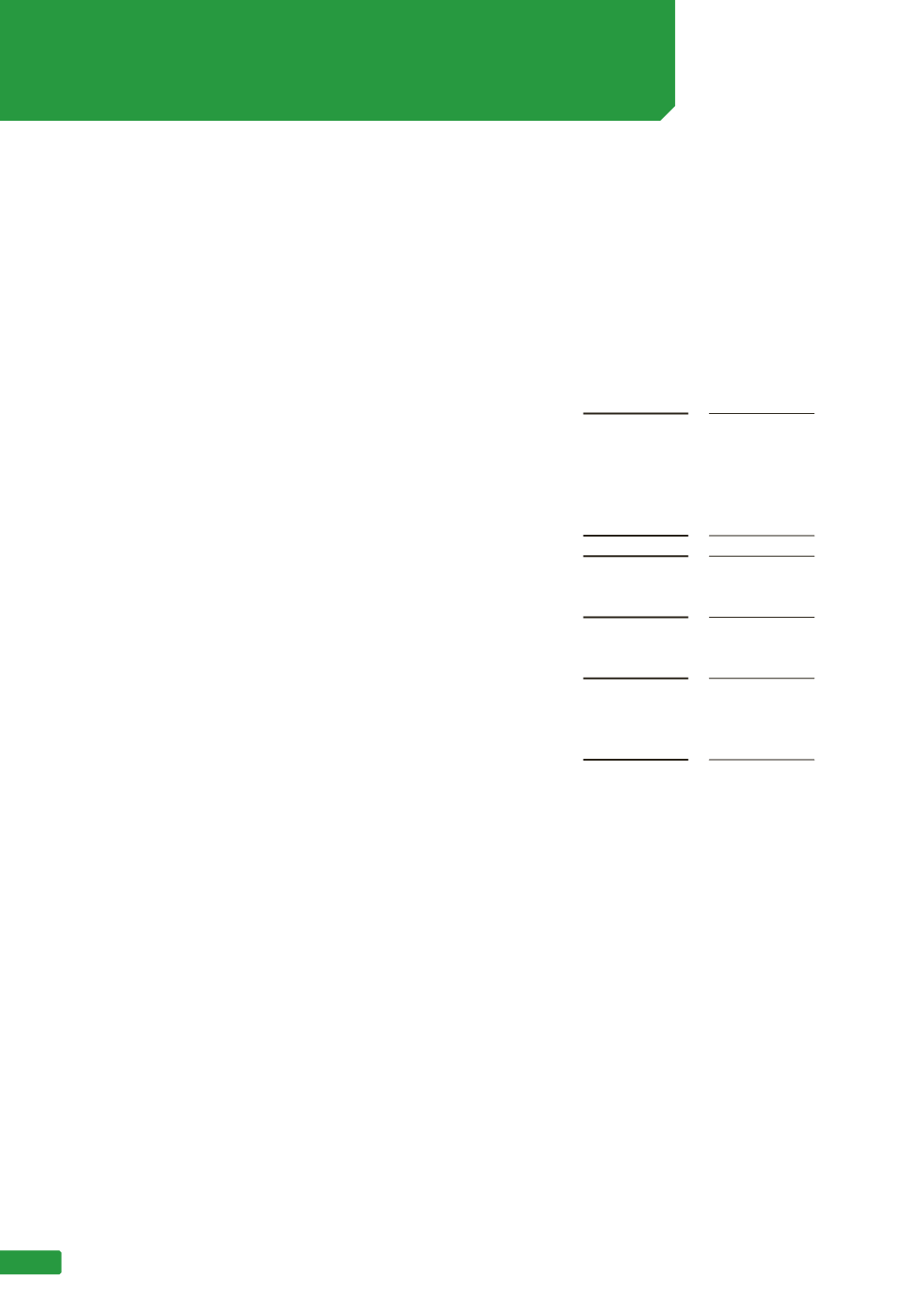

Consolidated

Notes

2016

$’000

2015

$’000

Profit/(Loss) for the year

117,566

134,598

Other comprehensive income

Items that may be reclassified to profit or loss - net of tax

Cash flow hedge charged to equity - interest rate swap 9(b)

884

1,277

Cash flow hedge charged to equity - foreign exchange 9(b)

19

-

Cash flow hedge net transfer to profit and loss -

foreign exchange

9(b)

-

22

Total items that may be reclassified

subsequently to profit or loss

903

1,299

Items that will not be reclassified to profit or loss - net of tax

Revaluation adjustment property plant and equipment

9(b)

(138,260)

(43,695)

Re-measurement (losses)/gains on defined benefit plans

9(c)

(5,437)

3,678

Total items that will not be reclassified to profit and loss

(143,697)

(40,017)

Other comprehensive (loss)/income for the year,

net of tax

(142,794)

(38,718)

Total comprehensive (loss)/income for the year,

net of tax

(25,228)

95,880

Total comprehensive (loss)/income for the year is

attributable to:

Equity holder of Australian Rail Track Corporation Ltd

(25,228)

95,880

The above consolidated statement of comprehensive income should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 JUNE 2016

52